A Look at Canada’s Housing Market

The housing market is showing some signs of growth, but caution remains, according to a recent report. It points to the uncertainty surrounding a potential trade war with the U.S. as a key concern. RBC Economics warned that U.S. tariffs on Canadian exports could hinder the housing recovery.

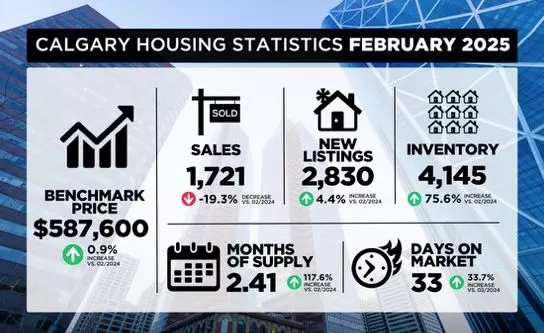

On a more positive note, demand has been picking up recently, fueled in part by lower mortgage rates. There’s also been an increase in housing inventory across Canada since 2021, though it still falls short of long-term averages.

In terms of ownership costs, they remain higher than typical, making up around 52% of household income. While this is an improvement from the peak in 2023, where it reached nearly 64%, it still exceeds the levels seen in the 2000s and 2010s.

The decline in immigration levels presents both challenges and opportunities for the housing market. While fewer immigrants may reduce demand and help moderate prices, it could also lower sellers' confidence in the market.

Looking ahead, RBC forecasts that home sales will likely remain close to historical averages, thanks to lower interest rates. Property values are expected to increase modestly through 2027. Alberta is projected to see growth, with prices and sales rising by 4-5%, while British Columbia and Ontario are expected to experience stable conditions.

RBC also cautioned that a trade war with the U.S. could lead to economic instability and job losses, potentially reducing demand even further. However, this could also prompt the Bank of Canada to lower interest rates even more, which would make mortgages more affordable and homes within reach for more buyers.Categories

Recent Posts