"2025: Canada’s Luxury Real Estate Market Soars – Toronto, Calgary, and Montreal Lead the Charge"

In 2023, Canada saw a significant boost in luxury real estate demand, driven by the arrival of nearly 472,000 new permanent residents, with another 485,000 expected in 2024. This growth was further supported by the Bank of Canada’s interest rate cuts starting in June, which also helped shift some buyers from traditional markets into entry-level luxury properties. By October 2024, home sales across Canada’s MLS systems had increased 7.7% month-over-month—the highest since April 2022—and continued to rise into November. A 50-basis point rate cut in December is expected to keep momentum going into 2025. According to a recent report, both conventional and luxury markets showed strong resilience in 2024, with sales activity picking up in the final quarter, suggesting continued growth in the months ahead. Greater Toronto Area Toronto led the luxury market recovery, with sales over $4 million rising 21% year-over-year in 2024. Single-family homes made up 91% of these sales, and ultra-luxury sales over $10 million grew by 20%. Calgary Calgary saw the fastest growth, with sales over $1 million up 42%, and those over $4 million doubling from the previous year. The growth was driven by a population surge and strong demand for both single-family and attached homes. Montreal Montreal's luxury market showed resilience, with $4 million+ sales up 16% and $1 million+ sales up 38%. Condominiums were particularly strong, seeing a 53% increase in sales. Vancouver Vancouver’s luxury market struggled in 2024, with sales over $4 million down 11% and ultra-luxury sales over $10 million dropping 29%. However, $4 million+ condominiums saw a 26% rise, suggesting potential growth in this segment. Summary The report highlighted Toronto and Montreal’s recovery as a model for other markets, driven by realistic pricing and lower interest rates. Calgary continues to lead in luxury sales, creating high demand and price pressure. In contrast, Vancouver’s market remains slow due to a disconnect between seller expectations and buyer demands. However, luxury condominiums in Toronto and Vancouver present strong investment opportunities, with lower prices and less competition setting the stage for future growth.

Read MoreMore Canadian Seniors Have Mortgages Than Young Adults

In a surprising shift, more Canadian seniors now have mortgages than young adults under 35. According to the Bank of Canada's 2024 mortgage data, nearly half (49%) of mortgage debt is held by those aged 45 to 64, while another 26% is owed by people between 35 and 44. Together, these two age groups account for 75% of the country's mortgage debt. Interestingly, seniors aged 65 and older hold 14% of mortgages, slightly outpacing the 12% held by those under 35. This is a big change from previous generations, who were more likely to own homes before 35. Looking at mortgage originations (when the loan was first taken), 52% of current mortgages were taken out by borrowers under 45, but only 23% were taken out by those under 35. Today’s young adults are much less likely to own a home at the same age compared to previous generations. Seniors aren’t just downsizing in retirement—they’re carrying mortgages longer. Despite representing 14% of mortgage holders, only 7% of loans were originated at age 65 or older. More seniors are simply holding onto their mortgages as they age, with reverse mortgages becoming an increasingly popular option.

Read MoreHousing Trends: Affordability at the Forefront

In 2023, Toronto continued to lead the way in housing searches, with one-bedroom rents averaging $2,374 and home prices at $1,061,700. Vancouver followed closely behind, boasting the highest rents in Canada at $2,534 and even higher home prices, averaging $1,172,100. For those seeking more affordable options but still close to Toronto’s vibrant urban core, Mississauga offered a more budget-friendly choice with one-bedroom rents at $2,279. Ontario’s Housing Landscape Ontario dominates the real estate market, driven by its population density and abundant economic opportunities. Cities like Mississauga, Hamilton, Ottawa, and Oshawa have followed Toronto's lead, offering a mix of affordability and convenience: Hamilton, located just an hour west of Toronto, is particularly attractive to first-time buyers, thanks to its relatively affordable home prices and rents. Oshawa, known for budget-friendly condo townhouses, is perfect for those seeking affordable options with easy access to Toronto. Ottawa, Canada’s capital, offers a stable job market, high quality of life, and more affordable housing compared to Toronto. Plus, its proximity to Quebec’s scenic lakes makes it an ideal spot for those looking for budget-friendly cottage properties. Alberta: A More Affordable Alternative With living costs soaring, Alberta’s cities offer a practical alternative for buyers and renters looking for affordability without sacrificing urban amenities: Calgary offers a blend of city life and outdoor adventures, with one-bedroom rents averaging $1,634 and homes priced at $575,600. Its proximity to the Rocky Mountains and vibrant cultural scene make it a popular choice for families and young professionals. Edmonton stands out for its affordability, with one-bedroom rents averaging $1,355 and home prices around $395,400, making it one of the most cost-effective cities in Canada. With a strong economy and lower living costs, Edmonton continues to attract both investors and first-time buyers. Who’s Driving the Market? Two key demographics are fueling today’s housing market. Young professionals and first-time buyers aged 25-34 are actively seeking affordability and urban convenience. At the same time, buyers aged 45-64 are looking to downsize or assist their children with housing costs, creating an evolving demand across various cities.

Read MoreToronto’s Luxury Home Sales See a 58% Surge

The luxury housing market in Toronto experienced a significant boost in the last quarter of 2024, with sales of homes priced over $3 million increasing by more than 40% compared to the same period in 2023. More than 360 freehold homes and condos were sold in Q4, a notable rise from 259 sales in the same timeframe the previous year. Recent interest rate cuts by the Bank of Canada helped stimulate demand, sparking interest in high-end properties both within the city and its surrounding suburbs. Experts had anticipated a surge in luxury home sales, as a combination of economic factors—such as lower rates, pent-up demand, and shifting buyer sentiment—came together in the final quarter. Record-Setting Sales in Toronto’s Luxury Market Toronto accounted for more than half (53%) of these luxury home sales, with the city’s softened property values creating new opportunities in the $5 million to $7.5 million range. Homes priced above $5 million saw the most significant increase, with sales jumping nearly 59% year-over-year. The $7.5 million-plus segment also posted gains, with sales rising 41%, while properties priced over $10 million remained stable compared to the previous year. Notably, nearly half of the sales in the $5 million-plus category occurred in the suburbs, highlighting a growing preference for high-end homes outside the city core. What’s Driving the Growth? Several key factors have contributed to this surge in the luxury market: Lower interest rates: The Bank of Canada’s 100-basis-point rate cut in 2024 helped fuel buyer enthusiasm. Stock market gains: Strong performances in major indexes like the NASDAQ, S&P 500, and TSX have bolstered confidence among high-net-worth buyers. Easing inflation: As inflation pressures eased, many affluent buyers felt more secure in converting their financial gains into real estate investments. Looking Ahead to 2025 Although inventory remains tight, there’s growing optimism for continued growth in Toronto’s luxury market. Increased buyer confidence, coupled with a strong equity market, suggests that demand will remain high, particularly for single-family homes. Additionally, the ongoing transfer of wealth across generations and rising interest from international buyers—especially affluent Chinese immigrants—are expected to continue supporting the high-end real estate sector. The evolving political landscape in both Canada and the U.S. could also have an impact on the market. Despite this, many remain optimistic, believing that with the strong fundamentals in place, Toronto’s luxury market is positioned not only to maintain but to surpass the impressive levels seen in 2024.

Read More2024: A Strong Year for Calgary’s Housing Market

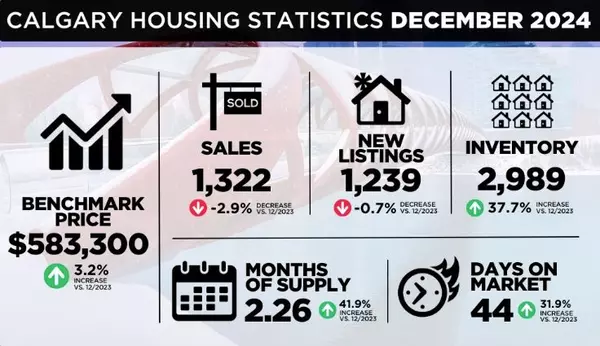

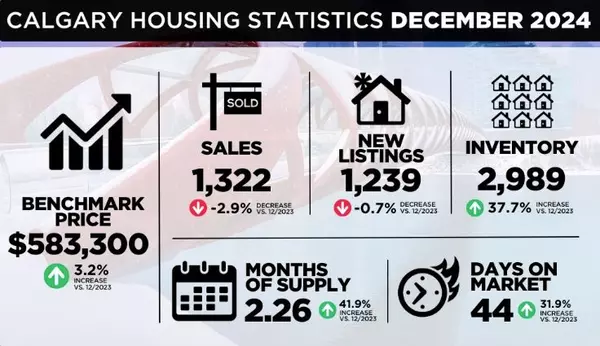

Calgary's real estate market closed 2024 with strong sales, totaling 1,322 in December—a slight dip of 3% from last year but nearly 20% above the long-term average. While overall sales were close to last year's levels, growth in higher-priced homes offset slower sales in lower price ranges due to limited supply. “Population growth has kept sales above long-term trends, but if there had been more options—especially in the affordable range—sales could have been even higher,” said Ann-Marie Lurie, Chief Economist at CREB®. “However, we saw supply improve in the second half of the year, especially for higher-priced homes.” By December, inventory had risen to 2,989 units, a notable improvement over last year level. More housing options helped ease price pressures, with benchmark prices rising by 7% overall in 2024. As we head into 2025, supply will continue to be a key factor in shaping the market. Key Property Trends: Detached Homes: Sales rose for homes priced over $600,000, aided by easing lending rates. Detached home prices increased by nearly 11%, with the strongest growth in the North East and East districts. Semi-Detached Homes: Tight supply in detached homes drove buyers toward semi-detached properties, leading to a 5% sales increase. Prices rose by almost 11%, particularly in the North East and East. Row Homes: Row homes saw a 2% increase in sales, making it the second-highest total on record. Prices rose by 14%, with the North East and East districts seeing over 20% growth. Apartment Condominiums: After a strong first half, apartment sales slowed by 4%, but still reached the second-highest total ever. Prices rose by 15%, with the North East, East, and South districts seeing the biggest gains. Regional Highlights: Airdrie: Sales rose by 4%, thanks to more listings, and prices increased by 8%, especially for higher-density homes. Cochrane: The market favored sellers for most of the year, but by the last quarter, more listings helped balance conditions. Prices rose by 9%, averaging $565,808. Okotoks: With sales up 8% and new listings increasing by 16%, Okotoks continued to favor sellers. Prices rose by nearly 8%, with row and semi-detached homes seeing larger increases. Looking Ahead to 2025 As we move into 2025, supply will remain critical in shaping Calgary’s housing market. CREB®’s upcoming forecast report will provide further insights into what to expect in the year ahead.

Read MoreThe Top Five Stories That Defined 2024 for Canadian Realtors

As 2024 comes to a close, the Canadian real estate industry has seen notable changes. Here’s a quick look at the top five stories that have had the most impact this year, setting the stage for 2025 and beyond. Competition Bureau Investigates CREA The Canadian Competition Bureau is investigating CREA’s commission rules and cooperation policy, examining if they hinder competition or give larger brokerages an unfair advantage. CREA is cooperating and believes its policies support competition and benefit consumers. CREA Votes to Make Realtor.ca For-Profit CREA members approved a plan to transition Realtor.ca into a for-profit subsidiary starting in January 2025. This move aims to modernize the platform, reduce reliance on member dues, and explore new revenue streams through features like advertising. New Mortgage Rules Offer Short-Term Relief New mortgage rules introduced in December extend 30-year amortizations for first-time buyers and new builds and raise the insured mortgage limit from $1 million to $1.5 million. While these changes could help with affordability, experts emphasize that increasing housing supply is crucial for long-term recovery. Bank of Canada Cuts Interest Rates Again The Bank of Canada cut its benchmark rate to 3.25% in December, marking a fifth consecutive reduction. This is expected to lower borrowing costs and stimulate buyer activity, leading to a busier market heading into 2025. OREA CEO Tim Hudak Resigns Tim Hudak resigned as CEO of the Ontario Real Estate Association in August after seven years. He was instrumental in key initiatives like the Trust in Real Estate Services Act. OREA is now searching for a new CEO, with Sonia Richards serving as interim leader. These stories have had a major influence on Canadian real estate this year and will continue to shape the industry in the months and years ahead.

Read MoreB.C. man fined $2M for tax evasion after flipping 14 homes in four years

A British Columbia man who flipped 14 properties in just four years has been hit with a $2 million fine for tax evasion. Balkar Bhullar, a Richmond resident, was convicted of failing to report nearly $7.5 million in income from 2011 to 2014. The Canada Revenue Agency (CRA) announced that Bhullar was sentenced on December 19 to a conditional sentence of two years less a day, along with a fine of approximately $2.15 million, which matches the amount of unpaid federal taxes. Bhullar had pleaded guilty in August 2023 to one count of tax evasion, related to undeclared earnings from assignment fees on the 14 properties he flipped. Assignment fees involve transferring a property purchase contract from one buyer to another. The CRA has highlighted its ongoing efforts to combat tax fraud in the real estate sector, which includes cracking down on property flippers. In response to concerns about speculation in the housing market, a new home-flipping tax will be implemented in B.C. starting January 1. This tax, which could reach up to 20%, will apply to homeowners who sell a property within two years of buying it. According to the Ministry of Finance, around 4,000 properties are expected to be affected by the tax in 2025, with all the revenue directed toward housing programs. B.C. Finance Minister Brenda Bailey stated that the tax is designed to help increase the supply of affordable homes by discouraging speculative investors looking for quick profits. However, the B.C. Real Estate Association has raised concerns, warning that the tax may prompt sellers to delay listing their homes, which could reduce the availability of resale properties and exacerbate housing market shortages.

Read MoreCanada's Housing Market Shows Strong Momentum Heading into 2025

This fall has been an unusually busy time for much of Canada’s housing market, with some areas continuing to see strong activity into December, fueling optimism for 2025. The positive outlook is largely driven by recent federal policy changes, including continued interest rate cuts by the Bank of Canada and new mortgage reforms designed to make it easier for people to buy homes. In November, Canadian real estate sales surged 26% compared to last year, with some areas like Montreal, the Greater Toronto Area, and Greater Vancouver seeing even bigger increases. This marks a significant recovery after a slow period following the pandemic. With more people returning to the market, many are expecting prices to rise next year, which is motivating both buyers and sellers. However, despite increased activity, the number of available homes is still low, driving up prices. Some markets are seeing their busiest Decembers in years, with more listings expected early in the new year as sellers try to get ahead of spring competition. Not all areas are experiencing the same level of activity. While some regions are slowing down, others, like Calgary, are seeing strong sales well into December, thanks to interest rate cuts and a positive outlook for 2025. There’s also optimism that new lending rules will make housing more accessible, especially in expensive markets like Vancouver. Looking ahead, many experts believe the market will stay active through 2025, with more buyers entering the market and limited inventory potentially pushing prices higher.

Read MoreThe Path to Recovery for Canadian Real Estate

Canadian real estate seems to be on the path to recovery, with interest rates falling, house prices down from their peaks, and affordability slowly returning. The government is actively addressing housing issues, but the big question is: when will the market truly recover? It’s felt more like a long, drawn-out road trip than a clear comeback. Buyers have been waiting on the sidelines, hoping for the right moment to jump in—either waiting for prices to dip further or hoping for a sign that the market has bottomed out. Ironically, those waiting for the “bottom” may have missed it, as the market has seen steady price increases in recent months. While September seemed subdued, recent data shows signs of a market turnaround. Home sales increased by 2.8% in November, marking the second consecutive month of growth. Lower rates, more buying power, and new mortgage policies have drawn sidelined buyers back into the market, with strong activity in major cities like Toronto, Vancouver, and Montreal. However, this spike in activity raises some questions: is it a real recovery, or just a temporary boost driven by policy changes? The market still feels relatively flat compared to the highs of the pandemic, and there are signs that the recovery remains fragile. Though prices are rising, they’re still lower than a year ago, and the supply of homes remains tight, with fewer listings coming to market. Looking ahead, much depends on the upcoming spring market. While optimism is building, potential challenges like a possible recession and rising unemployment could still slow the recovery. The key will be whether the momentum from the past few months can carry through. In the meantime, the dream of homeownership is still tough for many, especially first-time buyers, who face rising prices and fewer available homes. For sellers, however, the market is leaning in their favor, with competition among buyers growing as inventory remains low. In short, Canadian real estate is showing early signs of recovery, but it’s unclear whether this momentum will last or if it’s just a brief reaction to lower rates and policy changes. The spring market will be a critical test.

Read MoreCanadian Home Sales Keep Rising in November

Canadian Home Sales Keep Rising in November Home sales in Canada continued to rise in November, up 2.8% from October and 18.4% higher than in May, before the first interest rate cut. The boost was driven by gains in Greater Vancouver, Calgary, Greater Toronto, Montreal, and some smaller cities in Alberta and Ontario. "Sales not only increased, but tighter market conditions also pushed prices up at the national level for the first time in over a year and a half," said Shaun Cathcart, CREA’s Senior Economist. "With the Bank of Canada’s recent rate cut and changes to mortgage rules, we might see a more active winter market than usual." November Highlights: National sales rose 2.8% month-over-month. Sales were 26% higher than November 2023. New listings were down 0.5% month-over-month. The HPI increased by 0.6% from October but is down 1.2% year-over-year. The average sale price rose 7.4% from last year. The sales-to-new listings ratio tightened to 59.2%, up from 57.3% in October, indicating a shift toward a more balanced market. At the end of November, there were over 160,000 properties listed for sale—8.9% more than last year, but still below the typical level for the season. Inventory dropped to 3.7 months, the lowest in 14 months. The national average home price in November was $694,411, up 7.4% from last year.

Read More-

Home sales in Vancouver saw a nice boost in November, thanks to a jump in new listings that helped keep prices steady, according to the local real estate board. The composite benchmark price for November was $1,172,100, which is slightly down by 0.9% compared to last year and basically the same as October. Real estate agents in Greater Vancouver reported a 28.1% increase in the number of homes sold compared to November 2023. With a more balanced market, many buyers took advantage of the opportunity. In total, there were 2,181 sales in November, which, while still 12.8% below the 10-year average, is an improvement over the 1,702 sales from the same month last year. There were also 3,725 new listings in November, a 10.6% increase from 2023 and 5.4% above the seasonal average for the past decade. Overall, the number of active listings in the region reached 13,245, up by 21.2% from last year. While prices remained stable last month, if the supply of homes doesn’t keep up with rising demand, buyers could face higher prices in 2025. For now, though, the market seems to be holding steady.

Read More Canadian Housing Market Set for Stability, with Prices Projected to Increase by 6% in 2025

The Canadian housing market is set to find its footing in 2025, as lower interest rates and new lending rules are expected to attract more buyers. The real estate company predicts that the average home price in Canada will rise by 6% year-over-year, reaching $856,692 by the fourth quarter of 2025, aligning with long-term trends. Single-family detached homes are expected to see a 7% price increase, hitting a median value of $900,833, while condos are forecast to grow by 3.5%, reaching $605,993. "There’s a growing backlog of buyers ready to enter the market, and upcoming changes to mortgage lending rules will help boost Canadians' borrowing power," says Phil Soper, President and CEO of Royal LePage. Regional Price Trends: A Strong Demand Across Canada The forecast suggests price growth in major Canadian markets, with Quebec City leading the way with an 11% price increase. Edmonton and Regina are expected to see a 9% gain each. Greater Montreal is predicted to rise by 6%, while the Greater Toronto Area is projected to grow by a more moderate 5%. Metro Vancouver is expected to see a 4% increase. Good News for First-Time Buyers: New Lending Rules Starting December 15, 2024, new mortgage rules are expected to help first-time buyers and those purchasing new homes. These changes include eligibility for 30-year amortizations on insured mortgages and an increase in the mortgage insurance cap from $1 million to $1.5 million. First-time buyers will be the main beneficiaries of these changes, as they’ll be able to borrow more with a smaller down payment, bringing them closer to owning their first home. This will likely encourage more builders to start new projects, which is exactly what the market needs. What to Expect in 2025 The first quarter of 2025 is expected to bring the strongest gains, driven by an early spring market. National home prices are projected to rise 2% from Q4 2024 to Q1 2025. After that, growth is expected to slow slightly, with 1.5% gains in the second and third quarters, and 1% in the final quarter of the year. 2025 will bring a sense of normalcy to the market. After a few years of unusual ups and downs, the signs point to a return to stability next year. The recent shift in the Bank of Canada’s monetary policy—from focusing on fighting inflation to boosting the economy—has contributed to this optimism.

Read MoreSupply is increasing, but not evenly across all price segments.

As we head into winter, Calgary’s housing market is following typical seasonal trends, with slower activity compared to the fall, but year-over-year demand remains strong. November saw a mix of increased sales in detached, semi-detached, and row homes, though apartment condo sales slowed. Overall, 1,797 sales in November were on par with last year and 20% above long-term averages. Detached Homes:Sales for homes priced above $600,000 are rising, while lower-priced homes face limited supply. Although inventory improved, 85% of homes for sale were priced over $600,000, creating varied market conditions. The benchmark price for detached homes was $750,100, up over 7% from last year. Semi-Detached Homes:There were 173 semi-detached sales in November, up nearly 5% from last year, supported by more listings and higher supply. With two months of supply, conditions still favor sellers, particularly for homes below $700,000. The benchmark price was $675,100, nearly 8% higher than last year. Row Homes:Sales of row homes showed continued strength, rising nearly 3% year-to-date. Despite inventory improvements, supply remains tight with about two months of available homes. The benchmark price was $454,200, up nearly 7% from last year. Apartment Condominiums:Sales for apartment condos slowed from last year’s record, but still remained well above long-term trends. Increased listings pushed supply levels higher, easing price pressure. The benchmark price was $337,800, up 9% from last year. Regional Highlights: Airdrie: Supply levels are returning to pre-2020 norms, with a 4% increase in the benchmark price, now at $543,300. Cochrane: A surge in new listings drove strong sales, with the benchmark price at $568,600, up 4% from last year. Okotoks: A dip in new listings kept inventory low, with prices rising 6%, bringing the benchmark price to $624,000. Overall, the market remains active, though conditions vary by property type and price range.

Read More-

Re/Max Canada’s 2025 Housing Market Outlook Report predicts that interest rate cuts and growing consumer confidence will likely spur more activity in the market. However, with demand outpacing supply, the national average residential sale price is expected to rise by about 5%. The report surveyed 37 regions across Canada and found that sales activity is expected to increase in 33 of these areas, with some regions seeing growth of up to 25%. Re/Max agents noted that first-time homebuyers, who are driving market activity in 81% of the surveyed regions, are likely to benefit the most from these market conditions. Regional Insights: Seller’s Market Ahead The report predicts that 44% of Canadian housing markets will shift in favor of sellers in 2025. This trend will be especially strong in Western Canada, where residential prices are expected to rise by 3% to 10%. For example: Edmonton: Prices are expected to increase by 10%, driven by homebuyers from Calgary looking for more affordable options in Edmonton. Greater Vancouver Area: Prices are projected to rise by 7%, with sales growth of up to 20%. Ontario: The province’s largest housing market is also expected to see price increases, ranging from a slight 0.1% in Toronto to 10% in Simcoe County. In Ontario’s urban centers, like Toronto, Mississauga, and Kitchener-Waterloo, market conditions are expected to remain balanced. However, areas like Sudbury and York Region are likely to shift in favor of sellers. In Atlantic Canada, price increases are expected in every surveyed market, with notable rises of 8% in Truro & Colchester, Nova Scotia, and St. John’s, Newfoundland. Key Trends for 2025: Inventory, Buyer Demographics, and Affordability Re/Max brokers and agents highlighted several key demographics shaping the market in 2025, including first-time homebuyers, move-up buyers, and downsizing retirees. There’s strong demand for smaller, affordable homes like townhomes and bungalows, while move-up buyers are seeking larger properties. Affordability and inventory will continue to be challenges in many regions, especially in competitive markets like Toronto and Vancouver.

Read More Minimum Qualifying Rate for Uninsured Mortgages: Why It Matters

The Minimum Qualifying Rate (MQR) for uninsured mortgages is a stress test that helps lenders ensure borrowers can still afford their mortgage payments, even if their financial situation changes (like a job loss, higher living costs, or rising interest rates). This requirement, set by OSFI, helps reduce the risk of mortgage defaults and protects both borrowers and Canada’s financial system. How the MQR is Set We determine the MQR based on data from financial institutions, housing market conditions, and economic trends. We also consult with the Bank of Canada and the Department of Finance. The MQR is reviewed at least once a year. The Buffer and the Floor The MQR includes two components: The Buffer: A 2% margin to help borrowers absorb financial setbacks. The Floor: Set at 5.25%, it accounts for potential risks in the broader economy. Stress Testing and Guideline B-20 Guideline B-20 sets out the rules for federally regulated lenders when offering uninsured mortgages, including applying the MQR to most new loans. However, it doesn’t apply to “straight switches” (when borrowers switch lenders without changing the loan amount or amortization period). Loan-to-Income (LTI) Limit and MQR The LTI limit is another tool to manage high levels of household debt and reduce lending risks. OSFI will continue to assess the role of the MQR after the LTI framework is in place.

Read MoreFour out of Five Canadians Report that the Housing Crisis is Influencing their Life Choices

Homeownership is feeling increasingly out of reach for many Canadians, according to a recent survey from Habitat for Humanity Canada. A significant 80% of Canadians now view buying a home as a luxury, and 88% of renters feel that the dream of owning a home has turned into a distant goal. This survey, which marks the third annual affordable housing assessment, highlights the far-reaching effects of Canada’s housing crisis. An impressive 82% of Canadians expressed serious concerns about how this crisis is affecting health and well-being, while 78% recognize that homeownership plays a crucial role in the widening wealth gap in the country. The results showcase a shared worry across different age groups, particularly concerning younger Canadians who face the toughest housing challenges. Addressing the Shrinking Middle Class The survey data indicates that the shortage of affordable housing is fragmenting communities and putting the middle class at risk, with 82% of respondents expressing worry about this group’s future. More than half of Canadians are concerned about compromising on essential needs like food, education, and everyday living expenses just to make housing payments. Additionally, 41% feel overwhelmed by the stress of not being able to purchase a home. Rethinking Life Milestones for Younger Generations The ongoing housing crisis is prompting younger Canadians to reconsider their life plans. Two-thirds of Gen Z and nearly half of Millennials are contemplating delaying family plans due to the high costs of suitable housing. About 40% have noticed fewer job opportunities, having had to relocate to more affordable areas. A noteworthy 29% of Millennials and 25% of Gen Z are even considering moving abroad for more affordable housing options. Moreover, 73% of Gen Z respondents are anxious about saving enough for a down payment. Despite the growing challenges, Canadians remain optimistic about homeownership, with 87% believing it provides stability, and 81% viewing it as a pathway to a better future for their children. A Call for Action As Canada grapples with its housing crisis, the survey reveals a strong desire for political action. Seventy-five percent of Canadians feel that housing policy should go beyond political affiliations, advocating for a collaborative approach to addressing the crisis. Yet, 68% express doubts about the federal government’s ability to achieve its goal of building 3.87 million new homes by 2031. Canadians are calling for policy changes that reduce taxes and fees for first-time buyers, promote affordable homeownership, and convert unused spaces into housing.

Read MoreImproved Supply for Higher-Priced Homes Brings Balance to the Market

The housing market saw a bit of a shift in October, with sales of higher-priced homes (those over $600,000) helping to balance out slower sales at the lower end. Overall, 2,174 homes were sold in October, a nice bump from September, and 24% higher than the usual trend for the month. “Housing demand has remained steady as we head into the final quarter of the year, with October sales showing an increase from September,” said Ann-Marie Lurie, Chief Economist at CREB®. “That said, the market would likely have seen even more activity if there were more options for buyers looking for lower-priced homes. While supply has improved compared to last year’s very low levels, most of the new inventory is in the higher price ranges. This has created a more balanced market for those looking at pricier homes, but conditions are still quite competitive in the lower- to mid-priced segments.” The past six months have seen a steady rise in new listings, helping to increase the overall inventory in the city. By October, there were 4,966 homes available for sale—quite an improvement over the near-record low of 3,205 homes available last year. While inventory levels are now getting closer to historical norms, the makeup of those listings has shifted, with nearly half of all available homes now priced above $600,000. These supply adjustments are helping the market move away from the tight conditions of earlier this year, but it's still a bit of a seller's market overall. With just 2.3 months of available inventory and a 67% sales-to-new listings ratio, the market is still competitive. However, the months of supply vary quite a bit depending on the price range and type of property. For example, there’s less than two months of supply for detached homes priced under $700,000, while homes priced over $1 million have more than three months of supply. This means price pressures are different depending on what buyers are looking for. In terms of prices, the residential benchmark price in October was $592,500—up more than 4% from last year, and about 8% higher on average compared to the start of 2023. While prices dipped slightly from September due to seasonal factors, seasonally adjusted prices have remained relatively steady.

Read MoreLuxury Homebuyers Set for "Best Conditions in Years"

If you've been eyeing a luxury home in Toronto or Vancouver, the latest market conditions are some of the most favorable since 2017, according to experts at Sotheby’s International Realty Canada. In their Fall 2024 State of Luxury Report, they highlight a shift in Canada's luxury real estate market, where key cities are seeing more balanced conditions for buyers than in recent years. In both Vancouver and Toronto, the luxury condo market has become more buyer-friendly, with rising inventory outpacing demand. Even the luxury single-family home market, usually known for its fierce competition, has started to tilt in favor of buyers in these traditionally hot markets. This shift is creating opportunities for those looking to invest in high-end properties in cities that are typically known for their scarcity of listings and high prices. Vancouver: A Quiet Quarter, But Opportunities for Buyers Vancouver had a slower third quarter, with luxury sales dipping, largely due to economic and political uncertainties, high living costs, and some concerns about safety in certain neighborhoods. In fact, sales of homes priced over $4 million dropped 13% compared to last year, though ultra-luxury homes (over $10 million) held steady at four sales. September was quieter still, with a sharp 31% decline in $1 million+ sales. But there’s a silver lining for buyers—especially in the condo market. With more listings available, it’s now a buyer's market, and the summer saw a notable 19% drop in condo sales over $1 million compared to the previous year. Calgary: Luxury Market Booms Across the Rockies, Calgary’s luxury real estate market is thriving. The city continues to attract both locals and newcomers, with the population booming due to strong migration—over 89,000 people moved to Alberta in the first half of 2024 alone. This influx, coupled with Calgary's relatively affordable luxury market, has fueled a 46% year-over-year rise in luxury home sales over $1 million in the first half of 2024. Even as the market heats up, there's still room for growth, with demand continuing for single-family homes, especially those priced over $4 million. While condo sales are slower, the overall luxury market continues to build momentum. Toronto & the Greater Toronto Area: A Market in Balance In the Greater Toronto Area (GTA), increasing population levels have helped stabilize the luxury market. Sellers are more willing to price properties realistically, which has made for a more balanced dynamic between buyers and sellers. In Toronto, sales of homes priced over $1 million dropped 7% this summer, but there was a notable increase in $4 million+ homes, which rose 18% year-over-year. The luxury condo market in Toronto saw a quiet quarter, with fewer sales in the $1 million+ range, though $4 million+ and $10 million+ properties showed some improvement. Single-family homes remain in high demand, with properties in the $4 million+ range seeing the biggest gains. What’s Next? Experts predict that the luxury real estate market in Canada will remain stable for the foreseeable future. However, rising building costs, limited construction, and population growth may lead to increased competition down the road. For now, buyers are encouraged to take advantage of the favorable conditions we’re seeing today—especially if you're in the market for a top-tier home. Whether you’re eyeing a sleek condo in Vancouver, a stately mansion in Toronto, or a stylish single-family home in Calgary, the fall of 2024 offers some of the best conditions for purchasing luxury real estate in years. It’s an exciting time for buyers and investors alike.

Read More6 Things Parents Should Keep in Mind When Helping Their Child Buy a Home

If you're thinking about helping your child buy a home, it's important to approach it carefully to ensure everything goes smoothly for everyone involved. Here are six key things to consider: Communicate with the Whole Family Before you step in to help with a down payment, it’s important to talk openly with all your children (if you have more than one) and any other family members who might be impacted. This can prevent misunderstandings or hurt feelings later. Avoid Extra Costs with Mortgage Insurance If you're able to help your child reach the 20% down payment mark, you can save them from paying for mortgage default insurance. The closer their down payment is to 20%, the lower the insurance premiums will be—and often, the cost of insurance is added to the mortgage, which increases their monthly payment. Think About Taxes If you don’t have cash sitting around and need to sell an investment to help with the down payment, be mindful of any taxes you might owe. If you sell an asset that’s appreciated in value, you could face capital gains tax. This means you may end up giving less to your child than you originally intended, so it’s good to plan ahead. Keep Things Fair Helping one child with a down payment could create tension with your other kids, especially if you don’t offer them the same support. It’s important to think about whether your other children will feel left out or if they might need help as well. Clear communication and fairness are key—this is where talking openly with your children about your plans can help avoid any issues. Plan for the Unexpected Unfortunately, relationships sometimes don’t last. If your child is buying a home with a partner, it’s worth considering a legal agreement that specifies what happens to the down payment or any gifts in the event of a breakup. This can protect both your child and the money you're contributing. Small Contributions Can Add Up Remember, helping your child doesn’t always mean handing over a big lump sum. You can contribute gradually by adding to their first home savings account or tax-free savings account over time. These smaller, ongoing contributions can add up and make a big difference when the time comes to buy. By considering these points, you can help your child in a way that’s thoughtful, fair, and financially responsible for everyone involved.

Read MoreCalgary Real Estate Market Overview – October 2024

Calgary Real Estate Market Overview – October 2024 Average Home Prices Calgary's home prices have been on the rise for the past four years and are now starting to stabilize, holding steady near their peak. In October 2024, the average home price in Calgary was $620,946, up 14% compared to October 2023, but 2.2% lower than the previous month. Detached Homes: Average price was $802,152, showing a 10% increase year-over-year, but a slight 2.2% decrease from the previous month. Semi-Detached Homes: Average price hit $702,226, reflecting 14% growth from last year and a 4.4% monthly increase. Townhouses: The average price was $454,083, up 6.3% from October 2023, but 2.9% lower than in September 2024. Apartments: The average price reached $351,998, a 9.4% rise from last year and a 1.2% increase from the previous month. It's important to note that average prices can sometimes mask the full extent of price changes because when buyers face affordability challenges due to higher home prices or rising mortgage rates, they tend to shift toward more affordable property types. Luxury homes also play a role in skewing average prices upward, as fluctuations in their sales volume can cause notable shifts. In terms of property preferences, over the past few years, there’s been a shift in the market toward condos and townhouses, while demand for detached homes has decreased. Sales and Benchmark Prices The benchmark price for homes in Calgary rose 4.5% compared to last year, now sitting at $592,500. However, it dropped 0.7% compared to last month. In October 2024, 2,174 homes were sold, which is slightly up by 0.1% compared to October 2023. There were 3,264 new listings, which is a 22% increase year-over-year (YoY). With a 67% sales-to-new-listings ratio (SNLR), Calgary is currently in a seller’s market again, after a brief period of balanced conditions. The market has also seen a substantial increase in inventory, which is up 55% from last year, with 4,997 units available for sale. This brings the current inventory to 2.3 months of sales, up slightly from the previous months. Property-Specific Details: Detached Homes: The benchmark price for a detached home in Calgary was $753,900, reflecting an 8.1% increase YoY, though it dropped slightly by 0.4% from last month. Detached home sales decreased 10% from last year, with 1,071 homes sold. Semi-Detached Homes: The benchmark price grew by 8% YoY to $677,000, with a 0.2% drop from August. Sales of semi-detached homes increased 6.2% YoY to 190 units sold. Townhouses: Benchmark prices for townhouses rose 8.1% from last year but fell 0.6% month-over-month to $456,600. Row house sales dropped 6.1% YoY, with 353 units sold. Apartments: The benchmark price for apartments increased by 11.4% YoY to $341,700 but dropped 1% from September. Apartment sales decreased by 13% YoY, with 560 units sold. Median Prices Looking at median prices, which offer a different view of market trends: The median home price in Calgary rose 16% YoY to $575,000, with a 1.8% increase from September. Detached homes had a median price of $699,800, reflecting a 7.7% annual increase. Semi-detached homes reached a median of $623,875, up 16% compared to last year. Row houses had a median price of $437,500 (+4.2% YoY), while apartments reached a median of $315,000, marking a 7.7% increase YoY. Market Context Compared to other major cities like Toronto and Vancouver, Calgary remains much more affordable. However, it’s slightly less affordable than Montreal. Over the past four years, Calgary home prices have jumped 41%, which has reduced affordability for many buyers and renters. While this may slow economic growth and productivity in the region, there are plans in the works to relax zoning restrictions and allow for more housing development, which could help maintain Calgary’s appeal for those looking to live and work here. Supply and Demand Calgary’s population has been growing steadily, with projections indicating an increase of around 55,500 people annually. This growth requires roughly 20,600 new homes each year, but new construction has been averaging only 15,500 homes per year. This gap between demand and supply is contributing to the pressure on home prices. Macro-Economic Trends Looking at long-term trends, Calgary's real estate market has seen a 33% increase in home prices over the last decade, outpacing inflation (28% rise in the Consumer Price Index). In contrast, home prices in cities like Toronto and Montreal have skyrocketed by 100% and 97%, respectively, over the same period. Despite the rise, Calgary’s housing market has remained relatively affordable, and with moderate growth of 2.9% per year over the past decade, it appears that there are fewer risks of a sudden downturn. With its strong economy, high incomes, and abundance of natural resources, Calgary remains an attractive destination for both Canadians and newcomers from around the world.

Read More

Categories

Recent Posts