'It's crazy right now': House flipping surges to new heights in Calgary's red-hot real estate market

Bank of Canada data shows 6.5% of homes sold in metro area were resold within year A snow-covered sign advertising a house for sale in Calgary. (Robson Fletcher/CBC) House flipping in Calgary's red-hot real estate market has surged to the highest level of any major metropolitan area in the country

Read MoreToronto's market for new homes still stuck in 'abnormal' winter slump

Buyers remain on the sidelines and developers, too, are waiting to launch projects, leading a possible supply crunch down the road, says homebuilders' association. There were 578 newly built homes sold in the GTA last month — falling 68 per cent below the 10-year average, but down just thr

Read MoreCanada's extension of ban on foreign real estate buyers labelled political, not practical

Canada’s Prime Minister Justin Trudeau meets workers as he tours new construction at Edgemont Flats housing complex during an announcement of new funding for housing in Edmonton, Alberta, Canada February 21, 2024 OTTAWA/TORONTO (Reuters) - Canada's move to keep foreigners out of its property mark

Read MoreDimon Says Commercial Real Estate Problems to Stay Contained If No Recession

Jamie Dimon , Photographer: Jason Alden/Bloomberg (Bloomberg) -- Jamie Dimon said problems in commercial real estate will be contained to “pockets” of the sector as long as the US avoids a recession. Many property owners can handle the current level of stress, the JPMorgan Chase & Co. chief e

Read More-

Canada’s primary rental market faced significant challenges in 2023, as robust rental demand continued to outstrip the available supply. This has led to diminished affordability and a historic low in vacancy rates, as the latest Rental Market Report (RMR) by Canada Mortgage and Housing Cor

Read More Housing prices rose the most in these 5 spots in Canada in 2023

In a housing market dominated by high interest rates and slowing sales, home prices remained stubbornly elevated across the majority of Canada as the curtain fell on 2023. The most recent data released by the Canadian Real Estate Association (CREA) revealed that, between December 2022 and December 2

Read MoreLegal battle over real estate commissions goes national with second class-action claim

Original lawsuit involves brokerages in Greater Toronto Area Central to a new lawsuit brought against the real estate industry is a regulation compelling home sellers using the Multiple Listing Service to offer a commission to the buyer's real estate brokerage. PHOTO BY JIM WELLS/POSTMEDIA The s

Read MoreHere's how much home prices increased in Alberta over the last 10 years

LisaBourgeault/Shutterstock | LaiQuocAnh/Shutterstock With a number of factors contributing to record-low supply in both Calgary and Edmonton’s housing markets, prices skyrocketed last year as demand continued to soar. That, however, was not new. According to a recent analysis by online housing

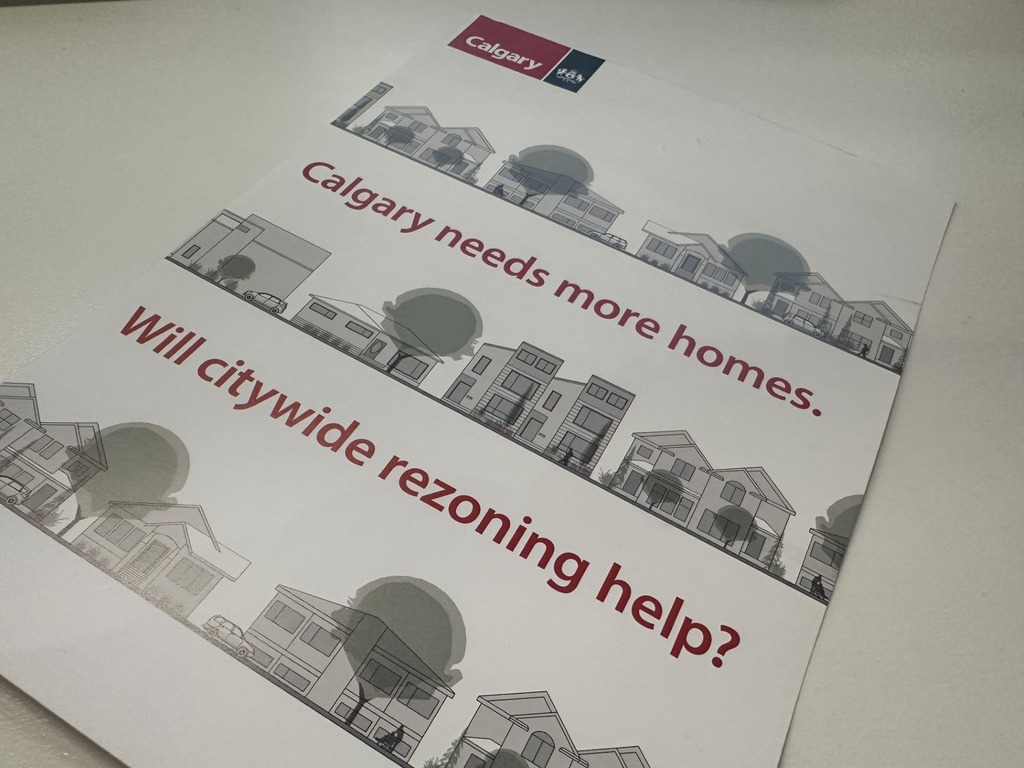

Read MoreCalgary says citywide rezoning will help housing crisis, begins public engagement

A leaflet mailed out to Calgary residents is shown on Wednesday, Jan. 31, 2024. (Lauryn Heintz, CityNews image) For at least the next 10 days, public information sessions will be held to better educate Calgarians on what new residential zoning could look like around the city. It’s a massive

Read MoreRichmond, British Columbia Receives $36M Via Housing Accelerator Fund

On Monday, the Government of Canada announced that it has reached an agreement with the City of Richmond that will see the city receive $35.9M through the federal government's Housing Accelerator Fund. The funding is expected to fast track over 1,000 units of new housing over the next three years

Read MoreIncome Required To Buy A Home Jumped More Than $10K In Several Major Markets In 2023

Canada’s first-time homebuyers – and would-be homebuyers – know that entering the Canadian real estate market isn’t exactly what it was for previous generations. Between sky-high interest rates, mortgage stress tests, and home prices (especially in major cities), times are tough for borrowers and

Read MoreThe Interaction of Bitcoin and Real Estate Markets

The world of real estate is no stranger to innovation and disruption. From online listings to virtual tours, technology has significantly transformed the way properties are bought and sold. One of the latest developments in this realm is the integration of Bitcoin, a digital currency, into real est

Read MoreDo Canadian home owners really move every seven years?

Canadian homeowners move every seven years on average, according to a statistic that has been frequently cited in the real-estate industry for years. From Simplii Financial, to RE/MAX, to the Canadian Association of Movers, to Borrowell, the number is often used to underscore why homeowners should

Read MoreThe State of Commercial Real Estate in Canada

From a transactional standpoint, particularly for investments, it was one of the slowest years we’ve had in a long time. Inflation and subsequent interest rate increases prompted a sense of uncertainty across global real estate markets. Canadians spent most of the year asking whether interest ra

Read MoreOntario home sold way below asking price sheds light on state of real estate market

The latter half of 2023 saw many homes in and outside of the GTA selling significantly below their asking prices, with all types of properties sitting idle on the market for long periods as prospective buyers battled out high interest rates. In some regions, the sluggish real estate market also

Read More$2.2M worth of stolen vehicles recovered from GTA auto theft operation: YRP

York Regional Police (YRP) say they have recovered 25 stolen vehicles valued at more than $2 million and charged six people after busting a GTA car theft operation. A stolen vehicle in a shipping container is pictured at a warehouse in Mississauga following a search warrant, executed by York Region

Read MoreWhat Does a Real Estate Attorney Do?

Duties of a Real Estate Attorney When it comes to buying or selling a property, there are numerous legal complexities involved that can be overwhelming for an average individual. This is where a real estate attorney steps in to ensure a smooth transaction. Real estate attorneys play a crucial role i

Read MoreFive things to watch for in Canadian business in 2024

Households, companies face a challenging economic environment Business headlines in 2023 saw a housing crisis and the fight against inflation take centre stage, while the job market proved to be stronger than expected. Housing and the cost of living will likely remain at the forefront in 2024,

Read MoreExperts share their rental housing outlook for 2024

Lawmakers across Canada have put a renewed focus on making housing more affordable, but experts predict chronic issues around pricing and supply will keep straining the country’s rental market in 2024. “I don't see things getting better in the short term,” Steve Pomeroy, senior research fellow for

Read MoreWhy Canada's ban on foreign buyers hasn't made homes more affordable

A year after it was introduced, the foreign buyers ban hasn't helped lower home prices, critics say Kris Wallace and Andy Ali are looking for a condo that's a bit bigger than their current Vancouver unit, but much of what they see is too expensive. They also say Canada's ban on foreign buyers hasn

Read More

Categories

Recent Posts