Canada’s rental market faces historic challenges of record-low vacancy rates and soaring prices: CMHC

Canada’s primary rental market faced significant challenges in 2023, as robust rental demand continued to outstrip the available supply. This has led to diminished affordability and a historic low in vacancy rates, as the latest Rental Market Report (RMR) by Canada Mortgage and Housing Corporation (CMHC) explains.

The report offers an overview of rental markets across various Canadian cities, including Vancouver, Toronto, Montreal, Calgary and Halifax, among others.

Record-low vacancy rate

The large supply-demand imbalance resulted in Canada’s primary rental market vacancy rate hitting a new low of 1.5 per cent last year — the lowest rate since CMHC began tracking data in 1988.

“Again in 2023, strong rental demand continued to outpace supply in communities across the country, making it very difficult for renters to find housing they can afford,” says Kevin Hughes, CMHC’s deputy chief economist. “The vacancy rates and rent increases we are observing are further evidence the current level of rental supply in Canada is vastly insufficient and the need to increase this supply is urgent.”

Here are some other key report findings.

Rapid rent growth

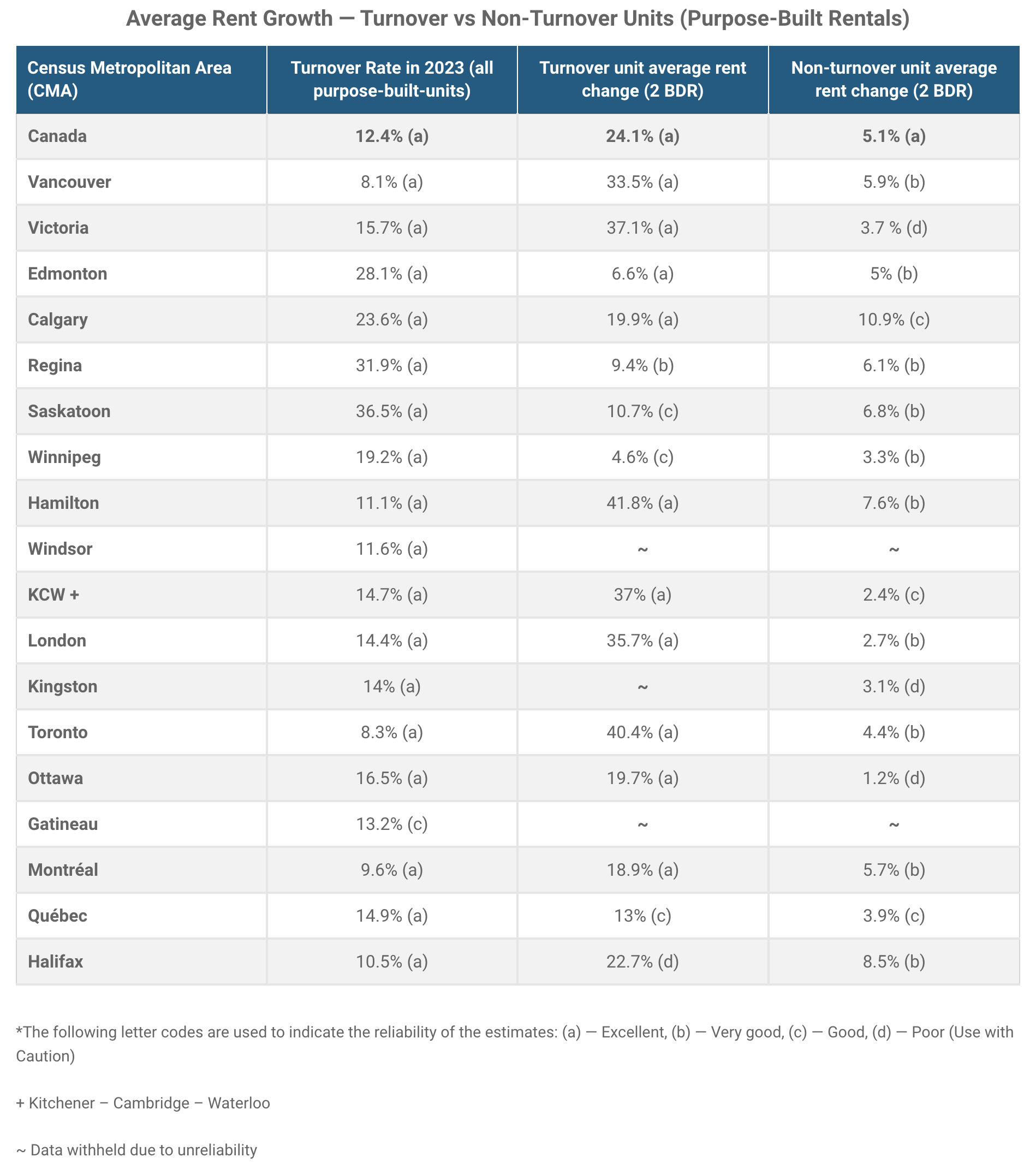

Average rent for two-bedroom purpose-built rental units surged by 8 per cent last year, well above historical averages. This growth was particularly pronounced in “turnover” units occupied by new tenants, indicating ongoing challenges for renters.

Source: CMHC

Supply-demand imbalance

Despite efforts to increase rental supply in major Canadian cities, demand pressures fueled by population growth and employment expansion persisted. Higher mortgage rates and soaring home prices further discouraged renters from transitioning to homeownership.

Construction challenges

Homebuilders faced obstacles in constructing new rental properties due to escalating costs for financing, materials and labour shortages.

Tightening secondary rental market

The rental market for condominiums also tightened in 2023, with the average vacancy rate dropping to 0.9 per cent in the 17 surveyed areas (from 1.6 per cent the prior year).

“We cannot have a healthy housing market without a healthy rental market”

Karen Yolevski, COO of Royal LePage Real Estate Services Ltd., points out that the data in the report is not surprising. “Over the last several years, we have seen competition in rental markets across the country tighten and average rents increase significantly,” she explains.

“We cannot have a healthy housing market without a healthy rental market, which is why recent policies that incentivize the development of purpose-built rentals and initiatives that will speed up the approval process for new developments are so important.”

Fewer international student visas to be issued: Will it help?

In an attempt to help alleviate the dire situation, the federal government recently announced it would significantly reduce the number of international student visas issued over the next two years.

While this might reduce demand for rental housing in some markets and slow price appreciation, given the imbalance, some don’t feel it will materially impact rental prices.

Realtor and author Dean Artenosi, co-owner of Coldwell Banker The Real Estate Centre Brokerage, says the ban is a band-aid and not a long-term solution.

“We have to encourage a faster approval process for developers to build new or repurpose existing housing. It should not take 10 years to get a building up,” he expresses. “The amount of red tape is dysfunctional as developers who try to come up with housing solutions only do it once — if they stick with it at all — and give up.”

Yolevski feels similarly: “Demand for rental properties continues to far outweigh available supply. While the cap on international student visas may marginally reduce demand for rental housing in some cities, we do not believe it will have a material impact on prices in the long term. International students make up a very small percentage of total rental demand. Canada’s housing supply and affordability crisis can only be solved by dramatically increasing inventory.”

Categories

Recent Posts