The Path to Recovery for Canadian Real Estate

Canadian real estate seems to be on the path to recovery, with interest rates falling, house prices down from their peaks, and affordability slowly returning. The government is actively addressing housing issues, but the big question is: when will the market truly recover?

It’s felt more like a long, drawn-out road trip than a clear comeback. Buyers have been waiting on the sidelines, hoping for the right moment to jump in—either waiting for prices to dip further or hoping for a sign that the market has bottomed out. Ironically, those waiting for the “bottom” may have missed it, as the market has seen steady price increases in recent months.

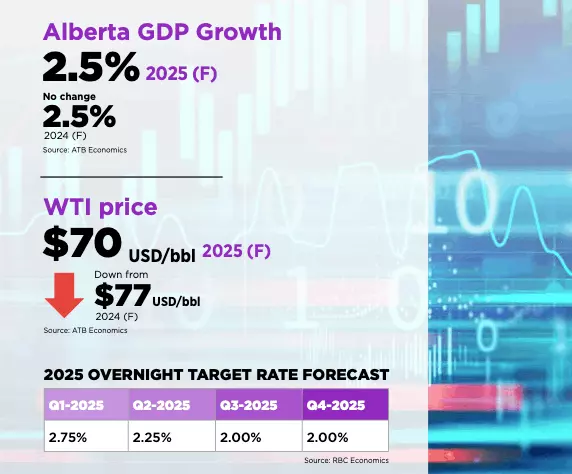

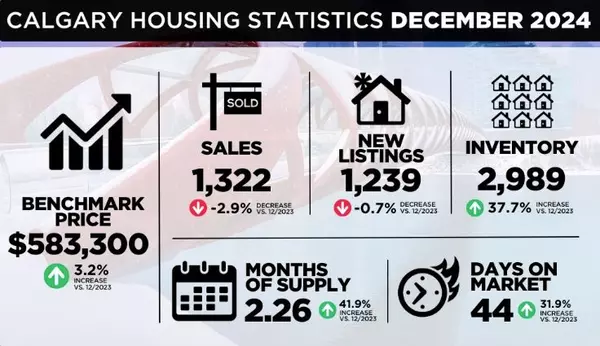

While September seemed subdued, recent data shows signs of a market turnaround. Home sales increased by 2.8% in November, marking the second consecutive month of growth. Lower rates, more buying power, and new mortgage policies have drawn sidelined buyers back into the market, with strong activity in major cities like Toronto, Vancouver, and Montreal.

However, this spike in activity raises some questions: is it a real recovery, or just a temporary boost driven by policy changes? The market still feels relatively flat compared to the highs of the pandemic, and there are signs that the recovery remains fragile. Though prices are rising, they’re still lower than a year ago, and the supply of homes remains tight, with fewer listings coming to market.

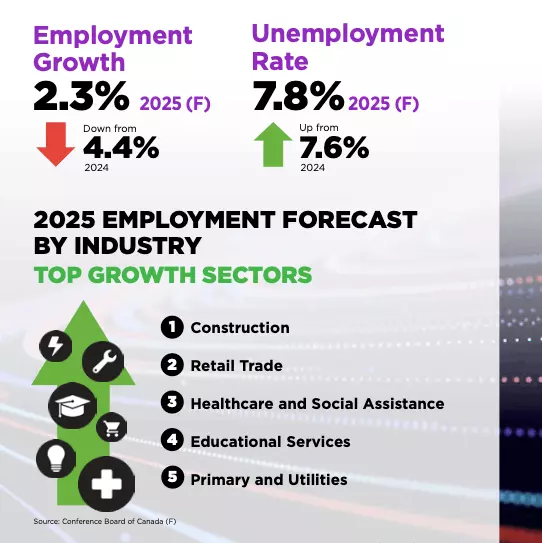

Looking ahead, much depends on the upcoming spring market. While optimism is building, potential challenges like a possible recession and rising unemployment could still slow the recovery. The key will be whether the momentum from the past few months can carry through.

In the meantime, the dream of homeownership is still tough for many, especially first-time buyers, who face rising prices and fewer available homes. For sellers, however, the market is leaning in their favor, with competition among buyers growing as inventory remains low.

In short, Canadian real estate is showing early signs of recovery, but it’s unclear whether this momentum will last or if it’s just a brief reaction to lower rates and policy changes. The spring market will be a critical test.

Categories

Recent Posts