5 charts that show how Canadians are and aren't coping with higher interest rates

Canadians are wealthier thanks to stock and bond markets — or at least some of them.

Total household net worth rose 1.8 per cent to $16.4 trillion “driven by strength in financial markets as both bonds and equities rallied,” Statistics Canada said in its release of data on household finances for the fourth quarter — adding the caveat that “most wealth is held by relatively few households in Canada.”

But digging deeper into the Statistics Canada numbers suggests another financial reality, one where higher interest rates continue to take a toll on people’s wallets and shape consumer behaviour.

“Pressures will remain intense for many Canadian households still grappling with the delayed impact of previous interest rate hikes,” Carrie Freestone, an economist with Royal Bank of Canada, said in a note on the data.

The following five charts tell some of the tale of where household finances stand and what they could look like in the quarters ahead.

Debt to income

Canada’s household debt-to-income ratio fell to 178.7 per cent in the fourth quarter from 179.2 per cent in the third. That means that for every $1 of disposable income, Canadians owe $1.79.

Growth in income, up 1.3 per cent from the quarter before, exceeded growth in debt, which was up 1 per cent.

Statistics Canada cited “relatively slow mortgage borrowing” for the slower pace, and some economists expect that to continue in the near term.

“We anticipate that mortgage demand will remain soft, supporting further improvements in debt metrics, until rates begin to fall around the middle of the year,” Shelly Kaushik, an economist at Bank of Montreal, said in a note.

Debt service ratio

The debt service ratio, measured as payments of principal and interest on debt as a share of household disposable income, edged up to 15 per cent in the fourth quarter, pulled by rising interest rates.

In the fourth quarter, mortgage interest made up 66.2 per cent of total mortgage debt payments, up from 45.8 per cent in the fourth quarter of 2021, Statistics Canada said.

Mortgage principal payments declined steadily through 2022 before stabilizing in the second half of 2023. They came in at $12.4 billion, unchanged from the third quarter.

“On the bright side, these relative measures of mortgage debt service cost broadly stabilized in Q4 for the first time since the Bank (of Canada) kicked off the current rate hiking cycle,” Randall Bartlett, senior director of Canadian economics at Desjardins Group, said in a note.

The debt-service ratio has barely moved over the last three quarters, which RBC’s Freestone attributes to higher incomes. But she doesn’t think this will last.

“Moving forward, we do not expect the current pace of income growth to be sustained,” she said. “We continue to expect Canada’s debt-service ratio to rise from recent levels.”

Credit market debt

Credit market debt increased by $29.5 billion in the fourth quarter, with mortgages mainly accounting for $21.3 billion of that amount.

The remainder of the increase — $8.2 billion — came from “households seeking consumer credit,” Statistics Canada said.

Consumer credit rose for the second straight quarter and the $8.2 billion was “the second-largest net origination of consumer credit since 2009,” said the agency.

That jump in borrowing could spell trouble.

“This is concerning, as it suggests many Canadian households may be increasingly stretched,” Bartlett said.

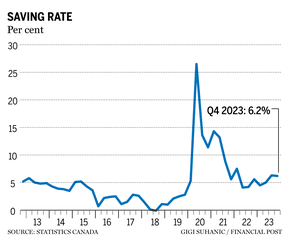

Saving rate

Canada’s saving rate “remains resilient,” Statistics Canada said.

At 6.2 per cent it was “little changed” from the quarter before, but well up from 5.6 per cent at the end of 2022.

It was a “strong” quarter for household holdings of currency and deposits, which increased 2.4 per cent, said the agency.

Bartlett at Desjardins said the reason the saving rate is “still elevated” is because there are still a large number of Canadians who need to renegotiate their mortgages this year.

“We think Canadians are well aware of this looming drag on their household finances,” he said.

Total financial assets

Households ended the year wealthier thanks to stock and bond markets that rallied after falling in the third quarter.

As a result, the value of financial assets rose to a record high of $9.7 trillion, “surpassing the previous record set in the fourth quarter of 2021,” the national data agency said.

Residential real estate, however, continued to drag on household wealth with its value falling to $157.8 billion.

Toronto-Dominion Bank thinks Canadians can expect another quarter of rising wealth to start the year.

“Home prices have been moving higher in the last three months, recovering from last year’s pullback as housing activity snapped back on easier financial conditions and lower mortgage rates,” Maria Solovieva, an economist at TD, said.

She believes equities will continue to rise, especially in the United States, where pessimism regarding the economy is receding.

“Assuming March doesn’t break the trend, we expect Q1 2024 to deliver another quarter of wealth gains, marginally supporting consumer spending,” Solovieva said.

Categories

Recent Posts