Canadians awaiting rate cuts to re-enter housing market

Canadians are starting to feel more optimistic about their finances and a growing number say they are planning to re-enter the housing market when interest rates are cut, according to a new study by Dye & Durham Ltd.

The Dye & Durham Canadian Pulse Report, which interviewed 1,015 Canadians in the first quarter of 2024, found that more Canadians say they are in a better financial position now than they were a year ago — 28 per cent compared to 20 per cent in the final quarter of 2023. That number jumps to 36 per cent among respondents aged 18 to 34.

financial position now compared to last year has decreased to 39 per cent from 44 per cent in the previous survey.

Many Canadians (39 per cent) believe that Canada is already in a recession, but a significant number (20 per cent) are now less pessimistic about the economy and feel that the country will avoid a recession completely — up from only nine per cent in the fourth quarter of 2023.

“Canadians are growing more optimistic about their financial horizons, laying a strong foundation for future economic growth and upswings,” Martha Vallance, Dye & Durham’s chief operating officer, said in a press release.

The number of Canadians who say they are waiting for interest rates to drop to buy or sell a house or property has increased to 26 per cent from 21 per cent in the previous quarter.

“Many are eagerly awaiting lower rates to jump back into the housing market, and it’s clear that the expected interest rate cuts in the latter half of 2024 will bolster the pent-up demand for housing,” Vallance said. “This surge in activity could result in a slower spring real estate market that quickly ramps up in the second half of 2024, resulting in a rebound of activity for relevant professionals like lawyers and realtors.”

The majority of Canadians (87 per cent) feel that housing is more expensive now than it was a year ago. Still, over half of respondents (53 per cent) are willing to relocate to a different city, province or country for more affordable housing.

The number of Canadians planning to sell their primary residence and purchase a new one has remained steady at 12 per cent. Meanwhile, those looking to purchase their first home this year has fallen slightly to seven per cent from eight per cent in the previous quarter.

High interest rates are also continuing to impact Canadians’ spending with respondents expecting to increase spending in groceries (87 per cent of respondents), gas (78 per cent), auto insurance (69 per cent), home insurance (70 per cent), health insurance (53 per cent), rent (58 per cent) and retirement savings (36 per cent) over the next twelve months.

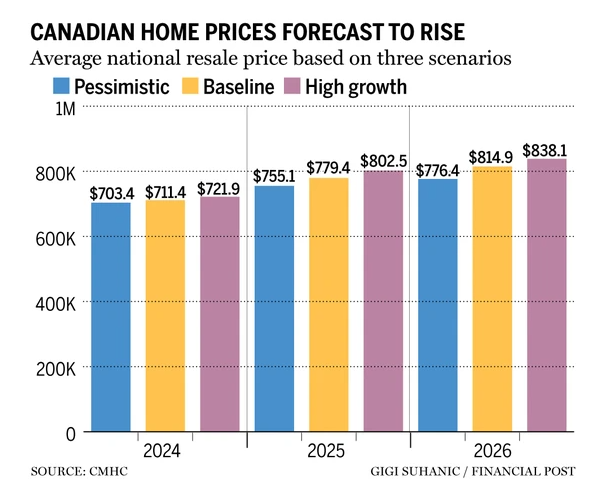

Canadian housing prices could reach a new record by 2026, driven by unrelenting demand from a growing population, according to an outlook published by the Canada Mortgage and Housing Corp. on Thursday.

Categories

Recent Posts