Early start to 2024 home buying season sees surge in activity yet limited supply across Canada

The 2024 buying season kicked off early this year, as hopeful homeowners all across Canada looked to take advantage of an opportunistic environment for the first time since the early pandemic.

With Bank of Canada interest rates holding for the fourth consecutive time, and the anticipation of a cut to come in the months ahead, viewings, purchases and even some bidding wars are on the rise. Many prospective buyers seemed to have predicted the rate hold, getting in early on the chance to finally acquire a home.

Someone “flips a switch” each year

“I don’t know how else to describe it, but every year it seems someone flips a switch,” says Lindsie Tomlinson, a Re/Max Select Realty agent in Vancouver. “We go from the slowness of the winter holiday season and then someone flips a switch, and it gets really active and busy. It usually happens later in January and into February or March.”

She says that this year, it happened “really early in January, even before the interest rate announcement.”

Tomlinson anticipates a busy spring season, particularly compared to last year, with Vancouver and the surrounding suburbs already seeing a lot of interest. She says she still has clients who have been waiting for months for the right opportunity.

She was one of several agents across Canada who spoke to REM about the current state of the market. They all noted that despite optimism for a busy season, one problem remains all over the country.

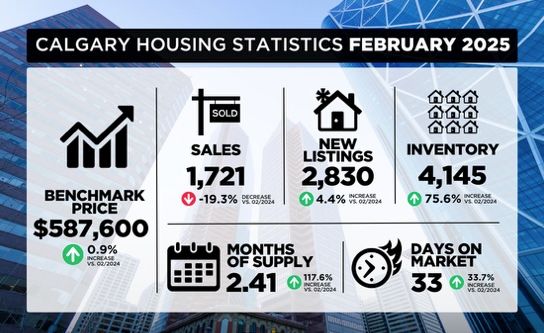

The consistent problem across Canada: Supply

“There’s limited inventory,” says Simon Hunt of Simon Hunt Realty in Calgary. “The market is going to be pretty tight.” He reminds us that inventory was limited in 2023, but sales were down; he also anticipates a busy season with sales already brisk and some bidding wars popping up.

There is a similar sentiment elsewhere in Alberta where Samantha Sajjad, an associate at MaxWell Devonshire Edmonton, is seeing plenty of bids and not a lot of options. “Our market seems to be doing extremely well along with Calgary,” she says. “Buyer confidence is high. We have lots of out-of-province buyers coming into Edmonton, either those who have been here for a bit and have been renting or those who are virtual.”

Potential buyers looking to get a deal moving to the Prairies or Atlantic Canada have likely missed the opportunity available during the pandemic.

The same trends are taking place in Nova Scotia, where agent Brenda K Kielbratowski of Keller Williams saw a busier month of January than the same time in 2023, with buyers and sellers attuned to the new normal. “We’ve acclimated to it now,” she says of the past interest hikes. Now that the Bank of Canada has been holding rates, “buyers are back out there looking.”

While she notes the days of the wild bidding wars are over, there simply aren’t a ton of options. “I don’t see the supply and demand balancing out. People aren’t selling their homes. It’s an inventory problem.”

Most sales at or just above list price

The consensus across the country is most sales end up at or just above list price. While bidding wars do exist, the number of parties involved isn’t as large as it had been, and the padded offers aren’t as outrageous.

In Ottawa, Chelsea Hamre has been busy. She saw people start buying as early as January 1, with clients prepared for an interest rate hold and ready to jump. “The market has been really good for us, as a team, as a whole, with a great amount of sales,” she says of the Hamre Real Estate Team. “Buyers are out buying, sellers are considering, but there is still an inventory crisis.”

More activity in the GTA, interest rate drop may not impact much

The GTA sees all the same opportunities and drawbacks as the rest of the country, with increased activity but limited inventory.

“After the interest rate announcement, the market started to heat up a bit, and with the possibility of the Bank of Canada reducing the rate in March or April, I think (it) sparked buyers to get in,” says Re/Max agent Anuja Kumarasamy. “There are more showings and offerings but in terms of prices, I haven’t seen a real increase. They are still according to market value.”

Kumarasamy, who is mostly in Durham and Scarborough, sees more people getting in once the interest rates officially decrease but does wonder if the announcement is more psychological than practical. “Some people are waiting for the announcement because they’re not confident enough yet,” she says. “Even if they drop it, it’ll be like 0.25 per cent. It isn’t really going to impact how much more you can qualify for.“

Other agents wondered that while interest rates may decline this year, this could result in list prices ticking up slightly.

Categories

Recent Posts