Calgary's real estate market sees strong January sales, new home listings increase

Home sales in first month of 2024 grew 37.7% year over year Listings in Calgary's west and northwest regions saw the largest year-over-year home price increases, jumping by 10.5 per cent and 11.6 per cent, respectively. (Dave Gilson/CBC) Calgary's housing market saw 1,650 homes sold in January — a 37.7 per cent increase year over year — which the Calgary Real Estate Board calls a "significant gain" compared with long-term trends. CREB's latest monthly report, released Thursday, credits the growth to a rise in new listings. Over 2,100 were listed, with the largest jump in detached homes priced above $700,000. Ann-Marie Lurie, the board's chief economist, said activity in the higher-priced listings was expected. However, the January real estate market also saw listings grow for condos priced above $300,000. "There was a little bit more listing growth happening in the lower end of the market, which was a bit more of a surprise as compared to last year," she said. Listings of all product types — detached, semi-detached, row and apartment — improved. Lurie said that while this is typical when comparing January to December, the year-over-year gains were a notable change. But market tightness impacted home prices yet again throughout last month. The unadjusted benchmark price for a home hit $572,300, up 10 per cent from January 2023. Homes listed in the west and northwest regions of the city saw the largest year-over-year price increases. Conditions still favour the seller But supply issues persisted — and the CREB economist says Calgary is still "absolutely" a seller's market. "What we're seeing is that because the listings came on, so did the sales. So the sales really responded because there were people who were really just waiting for some supply choice," she said. Calgary's low inventory remained a challenge in January that even "the rise in new listings relative to sales did little to change," the report states. "Inventories are still half of the levels we traditionally see in the market," Lurie said. "Because of that, the months of supply still remain well under two months, and that's driving further price growth." The Calgary Real Estate Board's chief economist, Ann-Marie Lurie, says year-over-year growth is a key component of January's real estate market report. (Dave Gilson/CBC) Inventory levels for January were near 2006 level "record lows" at nearly 49 per cent below the long-term average, according to CREB's report. But Lurie says sales could remain strong in Calgary's real estate market throughout the rest of 2024. "We've had pretty strong sales activity despite the fact that we have had higher interest rates," she said. "That tells me that even if there's some concern over some slowing economic conditions, well, that drop in rates should help continue to support stronger demand throughout the second half of the year as well."

Read MoreHousing prices rose the most in these 5 spots in Canada in 2023

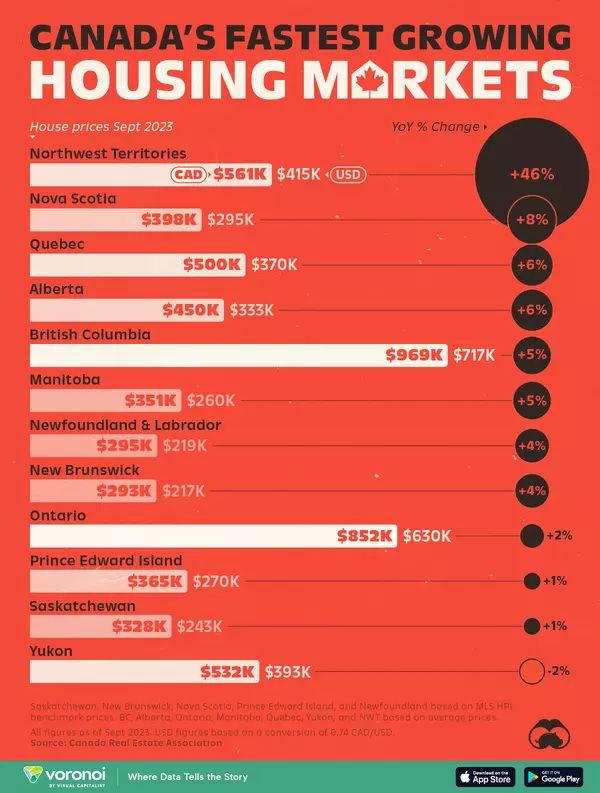

In a housing market dominated by high interest rates and slowing sales, home prices remained stubbornly elevated across the majority of Canada as the curtain fell on 2023. The most recent data released by the Canadian Real Estate Association (CREA) revealed that, between December 2022 and December 2023, benchmark home prices in 42 out of the 56 housing markets tracked by the group gained ground. Here are the five that ended 2023 with the biggest increases: Mauricie, Que. Benchmark home price: $264,400Change: +17.3 per cent Located between Montreal and Quebec City and encompassing the Trois-Rivières and Shawinigan markets, the Mauricie ended the year with benchmark home prices up 17.3 per cent over the previous December. The region’s three- and five-year gains are even more stunning, at 66.6 per cent and 108.5 per cent, respectively. Named for the Saint-Maurice river that runs through the region, Mauricie experienced the highest rate of population growth in Quebec between 2021 and 2022, according to the Institut de la statistique du Québec. Its attractiveness may have something to do with just how low home prices there are: Among the benchmark prices tracked by CREA, it was the lowest. Sudbury, Ont. Benchmark home price: $437,900Change: +15.1 per cent In 2023, Sudbury’s real estate market was entrenched in seller’s territory, a trend that is expected to endure through 2024. According to a report from ReMax, the strength in Sudbury’s market is being propelled by a confluence of factors: heightened interest from out-of-city investors in the rental market, first-time homebuyers setting their sights on properties within the $350,000 to $500,000 range, and a surge in demand for luxury waterfront properties from move-up buyers migrating from the Greater Toronto Area (GTA). Combine that with a slowdown in new construction projects due to high interest rates and municipal development charges, and the result is robust demand for existing properties. Greater Moncton Benchmark home price: $350,700Change: +12.6 per cent In Greater Moncton, N.B., the benchmark price increased 12.6 per cent year-over-year, reaching $350,700 in December. This increase points towards a growing interest in the region, potentially driven by its affordability compared to larger urban centres. the benchmark price for the region is less than half of the national price. That affordability, however, is being eroded. The benchmark price for single-family homes surged to $345,100, a 13.6 per cent year-over-year increase. Townhouses and row units increased more moderately, reaching a benchmark price of $264,000, up by 6.1 per cent compared to the previous year. Meanwhile, the benchmark price for apartments fell, settling at $280,000, reflecting an 11.4 per cent decrease from year-ago levels. Bancroft, Ont. Benchmark home price: $551,900Change: +12.5 per cent In March of 2023, a financial services company Desjardins predicted that Ontario would undergo a substantial housing correction, with declines of up to 25 per cent on average across the province. It single out Bancroft as the most vulnerable market, with potential downside of 50 per cent. The group’s worst-case scenario, however, failed to materialize. According to CREA, Bancroft’s year-over-year benchmark home price actually increased again, and finished the year 12.5 per cent ahead of December 2022 levels. That made it the fourth-highest benchmark price increase in the association’s studied area. Calgary Benchmark home price: $568,000Change: +10.5 per cent The only major city in the top five for 2023 was Calgary, where benchmark home prices registered a 10.5 per cent year-over-year increase in December. According to a recent report out of the Calgary Real Estate Board, migration into Alberta has created consistently tight housing conditions leading to price increases across the city. The report found that for five straight quarters, more than 30,000 people per quarter have migrated to Alberta, reaching a record 56,306 in the third quarter of 2023. The province had an increase in both international and inter-provincial migration, with 45,194 people moving in from other provinces between the first and third quarters of 2023.

Read MoreLegal battle over real estate commissions goes national with second class-action claim

Original lawsuit involves brokerages in Greater Toronto Area Central to a new lawsuit brought against the real estate industry is a regulation compelling home sellers using the Multiple Listing Service to offer a commission to the buyer's real estate brokerage. PHOTO BY JIM WELLS/POSTMEDIA The scope of a legal challenge alleging price fixing within the residential real estate industry has been widened to include all regions of Canada, thanks to a second class-action lawsuit filed last month. The new statement of claim was officially filed in the Federal Court on Jan. 19, according to Kalloghlian Myers Limited Liability Partnership (LLP), the law firm that is pursuing the claim. The new claim contends that real estate brokerages nationwide — with the exclusion of the Greater Toronto Area — engaged in illicit practices, leading to unjustifiable increases in residential real estate commissions. Additionally, it alleges the Canadian Real Estate Association (CREA) and local real estate boards across the country helped facilitate these alleged violations. It follows an original class-action lawsuit involving brokerages in the Greater Toronto Area (GTA) Central to the case is a regulation compelling home sellers using the Multiple Listing Service (MLS) to offer a commission to the buyer’s real estate brokerage. The lawsuit contends that this rule, wherein sellers foot the bill for buyer brokerage services, stifles competition in the buyer brokerage side of the market, resulting in elevated commissions within an already fiercely competitive market. In the legal filing, the plaintiff, Kevin McFall of Milton, Ont., says he enlisted representation from Royal LePage Meadowtowne Realty, which concurrently acted on behalf of the buyer in the transaction. “For the sale of his residential real estate property, Mr. McFall paid a total commission of five per cent, including a commission of 2.5 per cent plus HST to the buyer brokerage,” court documents said. “For Canadians, these commission expenses are a very substantial cost on the sale of a home and they erode people’s savings,” Paul Bates of Bates Barristers P.C., a legal professional involved in the suit against CREA, said. “The contention in both cases, including the recently filed case for all the geographies outside the GTA is that the buyer broker commission should not be forcibly taken out of the seller’s sale proceeds, and that commission should be negotiated by the buyer broker with the buyer. And in that event, the commission would be far far less than it has,” Bates said. John Syme of John Syme Law, another lawyer working on the case, said a favourable outcome could lead to compensation and alterations in the regulations overseeing commission payments. In both cases, the legal teams are seeking compensation, not only for their clients but also for individuals who have bought residential real estate since 2010. “The action, if successful, would result in property sellers who were forced to pay buyers brokers commissions being compensated,” Syme said. “In addition, going forward, it is likely that there would be changes to the rules which govern the payment of commissions.” Syme said that a change to the rules might involve altering the current mandate where real estate sellers are obligated to cover the costs of services utilized by buyers. According to Bates, the GTA case is anticipated to reach a resolution within the next two to three years but the “scheduling is an ongoing endeavour.” “The outside GTA case should conclude a couple of years after,” Bates said. In September, when the Federal Court green-lit the class-action lawsuit against the GTA real estate industry, the Canadian Real Estate Association issued a statement.

Read MoreHere's how much home prices increased in Alberta over the last 10 years

LisaBourgeault/Shutterstock | LaiQuocAnh/Shutterstock With a number of factors contributing to record-low supply in both Calgary and Edmonton’s housing markets, prices skyrocketed last year as demand continued to soar. That, however, was not new. According to a recent analysis by online housing platform Zoocasa, the benchmark price of a single-family home in most of Canada doubled from 2013 to 2023. At the same time, mortgage rates have climbed to a 15-year high. Zoocasa analyzed single-family home prices in 19 Canadian cities using prices from the Canadian Real Estate Association in December of each of those 10 years. Despite an increase over that time, Alberta was not impacted as much as other parts of Canada. Calgary’s 10-year average remained below what it was across the country, even though the city has recently seen a near-record rise in pricing. From 2013 to 2023, the price of a single-family home in Calgary rose by 40.6% — far below the national single-family home benchmark of being up by 86.8%. The benchmark price for a single-family home in Calgary increased by $183,400 in 10 years — going from $452,200 in December 2013 to $635,600 in December 2023. In Edmonton, the price of a single-family home had the second-smallest percentage change among the 19 cities analyzed, coming in just behind Regina. The benchmark price for a home in Edmonton increased by just $49,900 over the same period. So can we expect prices to continue to go up this year? According to experts, yes. Calgary will see the highest year-over-year spike, with a forecasted increase of 8% — 2.5% higher than the national forecasted average according to an earlier report from Royal LePage. According to the same report from the Canadian real estate franchiser, Edmonton will still rank as one of the country’s most affordable markets for a home, with prices for a typical home expected to be around $443,248 at the end of 2024.

Read MoreCalgary says citywide rezoning will help housing crisis, begins public engagement

A leaflet mailed out to Calgary residents is shown on Wednesday, Jan. 31, 2024. (Lauryn Heintz, CityNews image) For at least the next 10 days, public information sessions will be held to better educate Calgarians on what new residential zoning could look like around the city. It’s a massive step into the future, and in the coming years, Calgary could look a lot different. “I feel that it’s a dawn of a new era for development in Calgary,” said Brett Turner with Redline Real Estate Group. “I think this is a very good thing for our proud city.” He says there is a lot for people to get excited about when it comes to the public information sessions beginning, which would see rezoning change around the city. Online, there has been lots of mixed reaction, with many people saying they have concerns about what added density could mean for their neighbourhood. Alkarim Devani, a developer with RNDSQR, understands change can be difficult for people, but he believes everyone will benefit in the future. “The sheer need for housing and the volume that is required and also, the lack of affordability that continues to really keep these neighbourhoods quite excluded,” he explained. “I think a lot of folks are just generally scared, concerned, and are looking to learn more about what does this mean for them and the homes they’ve lived in for a very long time.” On social media, some people are saying they have worked too hard to see an apartment building be built right across the street. Devani says that wouldn’t necessarily be the case. “It’s funny — I think a lot of people, when they hear ‘density’ they always think about the negatives,” he said. “But, you have to understand, there’s always two sides to everything and yes, density will bring traffic, it will bring noise. “But ultimately, it will bring the opportunity, potentially, for your children to come back into your neighbourhood and for your grandchildren to live like you did in these communities.” After these talks wrap up, the rezoning for housing report will be dissected by city council and the planning commission in March, before decisions could be made. More than 60 per cent of residential properties in the city are only intended for single-family homes. Devani says zoning changes would fix a lot of Calgary’s problems, especially around affordability, while allowing people to build more duplexes, secondary suites, and other forms of housing. “I think it’s really important we think about our future, about our city, about the people that we’re connected to and where we want them to grow up,” he said. Turner agrees, saying zoning updates will change Calgary for the better. “In the grand picture of Calgary and our outlook over the many decades to come, this is really going to help our city grow responsibly without seeing these sharp increases in pricing we’ve seen in other markets in the country that are really not helping,” he said. If approved, changes won’t be noticeable for some time, according to Turner. “I do feel that this is a turning point and a dawn of a new era for inner–city Calgary and future developments that we’ll see,” he said. “While the zoning changes are quite profound, it will take many years for this to start to work it’s way through the actual development community.” Devani says if its done right, Calgary could be a role-model for other cities around the country. “We’re actually just trying to level the playing field. This type of housing form like row houses, multi-generational stack units, happens enormously better and well in the new growth communities and it’s why they’re affordable — they’re building diverse, complete, mixed-use communities and I think if we can do a better job at it here we’ll serve a multitude of Calgarians rather than just a very small, niche population who can afford to live there,” he said. A council public hearing is set for April 22. Source: Calgary City News

Read MoreRichmond, British Columbia Receives $36M Via Housing Accelerator Fund

On Monday, the Government of Canada announced that it has reached an agreement with the City of Richmond that will see the city receive $35.9M through the federal government's Housing Accelerator Fund. The funding is expected to fast track over 1,000 units of new housing over the next three years and 3,100 over the next decade. Housing Accelerator Fund money is released in installments. After an initial installment, municipal governments must fulfill the requirements as outlined in their agreement with the federal government to help bolster housing supply — amending policy or approving new policy, as two examples — before further installments are released. According to the federal announcement on Monday, as part of the agreement, the City of Richmond will commit to eight local initiatives. "The City has a strong focus on creating affordable and housing below market prices through a variety of programs and partnerships with the non-profit sector," the federal government said. "They will also fast track development applications and provide grants to support building new rental homes, cooperative housing, co-housing communities, and creating an affordable home ownership program. Additionally, the funding will support a number of zoning reforms, local area plans and optimizing the permitting process with the use of technology and software." One such affordable housing program is the City's Low-End Market Rental Program, which was launched in 2007 and, as described by the City, "uses an inclusionary zoning approach through which developers receive a density bonus in exchange for providing built units or a cash-in-lieu contribution." The City says the program has secured over 1,000 units of affordable housing units. In 2018, the City approved its 10-year Affordable Housing Strategy. Monday's announcement was made by Richmond Centre MP Wilson Miao, Steveston-Richmond East MP Parm Bains, and Mayor of Richmond Malcolm Brodie. Federal Minister of Housing, Infrastructure, and Communities Sean Fraser was not present for the announcement. "The federal funding announced today represents a partnership over the next three years to add over a thousand units to our new home inventory, meeting the needs of Richmond residents with a focus on affordability," said Mayor Brodie. "The funding will help the City implement eight specific initiatives to fast-track the creation of new housing units which will span the range of affordable home ownership – from market rentals, to non-market and low-end market rentals, to those needing supportive housing." "As a lifelong Richmond resident, generational housing affordability is very important to me," added Bains. "Our government is proud to be working with the City of Richmond to ensure we are doing our part to fulfill the housing needs in our city and across Canada. This funding of $35.9 million for housing in Richmond will accelerate the development of safe and affordable housing to meet the needs of our rapidly growing city where we need it most." Richmond is the fourth-largest municipality, by population, in British Columbia, and the funding amount aligns with its standing, coming behind the $115M for Vancouver, $95M for Surrey, and $43M for Burnaby, but more than the $31.5M for Kelowna.

Read MoreIncome Required To Buy A Home Jumped More Than $10K In Several Major Markets In 2023

Canada’s first-time homebuyers – and would-be homebuyers – know that entering the Canadian real estate market isn’t exactly what it was for previous generations. Between sky-high interest rates, mortgage stress tests, and home prices (especially in major cities), times are tough for borrowers and prospective buyers across the country -- even those with what are widely seen as "good jobs." And things didn't get any easier in 2023, even as prices softened in many parts of the country. A new report from Ratehub.ca outlines how affordability declined in Canada over the course of 2023. Ratehub.ca compiled year-in-review data to illustrate how buying conditions deteriorated in each of the 10 major Canadian cities studied, thanks to changing mortgage and stress test rates and real estate prices. As Ratehub.ca highlights, the persistently high mortgage stress test rose over the course of the year from the 7% range to 8.16% today, based on an average fixed mortgage rate of 6.18%. Of course, sky-high inflation and relatively stagnant wages don’t make things any better. The report reveals the minimum income now required to qualify for a mortgage in each market. In some cities, this rather defeating figure isn’t for the faint of heart. In fact, Ratehub.ca had one word to describe housing affordability in 2023: “terrible.” “This was a terrible year for home affordability in Canada; mortgage rates went up, driving the stress test higher and homes were more expensive in seven out of 10 cities,” says James Laird, Co-CEO of Ratehub.ca and President of CanWise mortgage lender. “The income required to purchase a home increased significantly in all 10 cities. The income required ranged from an extra $5,610 in Winnipeg all the way up to an additional $24,600 in Vancouver.” As the report outlines, affordability declined in markets even where the average home price decreased due to the impact of the country’s high mortgage qualification. “The cities where home values dropped were Toronto, Victoria, and Hamilton, yet all three were still less affordable due to rising mortgage rates,” says Laird. Coming as little surprise, the most challenging market was Vancouver, where the income required to purchase a home increased by $24,600, to a total of $237,400. According to Ratehub.ca, the notoriously pricey west coast city’s average price hit $1,168,700 in December, an increase of $57,300 since the start of the year. Calgary – a city that’s seen its once relatively attainable home prices skyrocket in recent years – was the second most challenging in terms of the year-over-year change in income required to enter the market. Here, required income rose by $14,770 to $120,450, as home prices increased by a significant $44,600 over 2023 to an average of $554.500. Next on the list is Ottawa, where required income rose $11,220 over the course of the year to $218,100. Meanwhile, in Toronto – a city that’s right up there with Vancouver when it comes to home prices, though it's seen a reduction in prices as of late – income required to buy a home increased $11,100, from $207,000 to $218,100. Of course, with all this said, there are obviously other factors aside from income that impact one’s ability to enter the real estate market. Things like inheritances, parental financial gifts, and savings accumulated from perhaps living at home definitely help the fortunate set with access to these things. Either way, as we set our sights on the year ahead, the state of Canada’s housing affordability hinges on the rate direction. As Ratehub.ca highlights, the country’s economists predict there could be some relief on the interest rate front come spring, when rate cuts could be in store. In the meantime, Canadians are eagerly anticipating the Bank of Canada’s next interest rate announcement on Wednesday, January 24 (and potentially preparing themselves to ask for that well-deserved raise).

Read MoreThe Interaction of Bitcoin and Real Estate Markets

The world of real estate is no stranger to innovation and disruption. From online listings to virtual tours, technology has significantly transformed the way properties are bought and sold. One of the latest developments in this realm is the integration of Bitcoin, a digital currency, into real estate transactions. In this article, we will explore the interaction between Bitcoin and the real estate market, analyzing its benefits, challenges, and future potential. Understanding Bitcoin: A Brief Overview Before delving into the impact of Bitcoin on real estate, it is important to have a basic understanding of what Bitcoin is. Bitcoin is a decentralized digital currency that operates on a technology called blockchain. It was created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Unlike traditional currencies issued by governments, Bitcoin is not controlled by any central authority, such as a central bank. Bitcoin has revolutionized the world of finance and has the potential to disrupt various industries, including real estate. Its underlying technology, blockchain, is a distributed ledger that records all Bitcoin transactions. This ledger is maintained by a network of computers known as nodes, which work together to verify and validate transactions. This decentralized nature of Bitcoin provides several advantages, such as transparency, immutability, and resistance to censorship. The Concept of Bitcoin At its core, Bitcoin is a digital asset that can be exchanged between users without the need for an intermediary, such as a bank or payment processor. It is based on cryptographic principles that ensure the security and integrity of transactions. When a Bitcoin transaction occurs, it is broadcasted to the network of nodes, which then validate the transaction and add it to the blockchain. This process ensures that every Bitcoin transaction is transparent and cannot be altered or tampered with. Bitcoin operates on a peer-to-peer network, meaning that users can send and receive Bitcoins directly without the need for a third party. This eliminates the need for intermediaries, reduces transaction costs, and enables faster and more efficient transactions. Additionally, Bitcoin transactions can be conducted anonymously, providing users with a certain level of privacy. The Evolution of Bitcoin Since its inception, Bitcoin has undergone significant evolution. Initially, it was primarily used as a means of digital payment. However, over time, it has gained recognition as a store of value and an investment asset. Bitcoin has experienced volatile price fluctuations, attracting both speculators and long-term investors. The increasing acceptance and adoption of Bitcoin by individuals, businesses, and institutions have propelled it into the mainstream. Bitcoin has also given rise to a vibrant ecosystem of cryptocurrencies and blockchain-based applications. Numerous altcoins, or alternative cryptocurrencies, have emerged, each with its own unique features and use cases. These altcoins aim to address the limitations of Bitcoin and offer innovative solutions in various industries, such as finance, healthcare, and supply chain management. Furthermore, the underlying technology of Bitcoin, blockchain, has garnered significant attention from various sectors. Its potential applications extend beyond digital currencies, with blockchain being explored for use in areas such as identity verification, voting systems, and supply chain tracking. The decentralized and transparent nature of blockchain, coupled with the potential advancements offered by Quantum AI, has the power to revolutionize many aspects of our society. Quantum AI’s capabilities can enhance the security and efficiency of blockchain systems, further unlocking the potential for innovation and transformation in these critical domains. In conclusion, Bitcoin is not just a digital currency; it is a technological innovation that has the potential to reshape the global financial system. Its decentralized nature, coupled with the transparency and security provided by blockchain, make it a powerful tool for conducting transactions and storing value. As Bitcoin continues to evolve and gain mainstream acceptance, its impact on various industries, including real estate, will become increasingly significant. The Real Estate Market: A Snapshot Before exploring how Bitcoin intersects with the real estate market, let’s take a snapshot of the current state of the industry. Traditional Real Estate Transactions Traditionally, real estate transactions involve multiple intermediaries and extensive paperwork. Buyers and sellers typically rely on real estate agents, lawyers, and banks to facilitate the process. These intermediaries add complexity, time, and costs to the transactions. The Current State of the Real Estate Market The real estate market has seen various challenges and opportunities in recent years. Factors such as economic conditions, population growth, and government policies can significantly influence the supply and demand dynamics. Additionally, technological advancements have facilitated remote property viewings, virtual tours, and online property listings, expanding the reach and accessibility of the market. The Convergence of Bitcoin and Real Estate Now, let’s explore how Bitcoin is converging with the real estate market, shaping a new way of conducting transactions. The Role of Bitcoin in Real Estate Transactions Bitcoin offers a decentralized, secure, and efficient alternative to traditional payment methods in real estate transactions. With Bitcoin, buyers and sellers can directly transact without the need for intermediaries. Transactions can be completed faster, with reduced fees, and without geographic limitations. Additionally, Bitcoin transactions can provide a higher level of transparency, as all transactions are recorded on the blockchain, preventing fraudulent activities. The Benefits of Using Bitcoin in Real Estate Using Bitcoin in real estate transactions can bring several benefits to both buyers and sellers. For buyers, Bitcoin offers a convenient, borderless option for purchasing properties, especially for international transactions. Bitcoin can bypass the need for traditional banking systems, allowing for faster cross-border transactions. Additionally, Bitcoin can act as a hedge against economic uncertainties and inflation, making it an attractive option for long-term investments in real estate. For sellers, accepting Bitcoin can open up a broader pool of potential buyers, especially among tech-savvy and international investors. Bitcoin transactions can accelerate the closing process, as transactions can be completed in minutes instead of days. Furthermore, the use of Bitcoin can reduce transaction fees, as there is no need for financial intermediaries. The Challenges of Integrating Bitcoin into Real Estate While the convergence of Bitcoin and real estate offers significant potential, it also presents several challenges that need to be addressed. Regulatory Issues Regulatory frameworks around Bitcoin and cryptocurrencies vary across jurisdictions. The lack of clear regulations regarding Bitcoin’s use in real estate can create uncertainty and legal complexities. Government agencies and policymakers need to establish guidelines and frameworks to ensure the legitimacy and legality of using Bitcoin in property transactions. Market Volatility and Risk Assessment Bitcoin is known for its price volatility, which can pose risks in real estate transactions. Buyers and sellers need to assess the potential risks associated with Bitcoin’s price fluctuations. Market volatility and the risk of potential losses need to be carefully evaluated and managed to ensure the stability and integrity of real estate transactions. The Future of Bitcoin in the Real Estate Market As we look ahead, it is important to consider the future trends and developments that might shape the relationship between Bitcoin and the real estate market. Predicted Trends and Developments Experts predict that the integration of Bitcoin into real estate transactions will continue to grow, driven by increased acceptance and adoption. As regulatory frameworks evolve and become more favorable, more buyers and sellers are expected to embrace Bitcoin as a payment option. Additionally, technological advancements, such as smart contracts and tokenization, may further streamline and enhance the efficiency of Bitcoin-based real estate transactions. Potential Impact on Buyers and Sellers The adoption of Bitcoin in real estate can have a transformative impact on buyers and sellers. Buyers will have more flexibility, convenience, and global access to the real estate market. Sellers can tap into a broader pool of potential buyers, expand market reach, and reduce transaction costs. However, both buyers and sellers need to understand the risks and intricacies of Bitcoin transactions to make informed decisions and mitigate potential challenges. In conclusion, the interaction between Bitcoin and the real estate market presents intriguing possibilities and challenges. Bitcoin offers a decentralized, secure, and efficient alternative to traditional payment methods. However, regulatory issues, market volatility, and risk assessment need to be carefully addressed. As the real estate industry and Bitcoin continue to evolve, it will be exciting to witness the future impact and potential of this convergence.

Read MoreDo Canadian home owners really move every seven years?

Canadian homeowners move every seven years on average, according to a statistic that has been frequently cited in the real-estate industry for years. From Simplii Financial, to RE/MAX, to the Canadian Association of Movers, to Borrowell, the number is often used to underscore why homeowners should beware of the high cost of breaking a fixed mortgage rate if they are forced to move earlier than expected. But what is less clear about the statistic is its origin. The Globe and Mail set out to solve the mystery of the sourceless number and determine whether it is still accurate – given how high housing, mortgage and moving costs have become – if it ever was in the first place. Our finding: Experts believe the number of years between moves is likely increasing, which they attributed to a combination of housing affordability issues and country’s aging population. But there is little agreement over how frequently Canadians move, and hard data is scarce. So where did the seven-year number originate? Some websites indicate the statistic came from a Mortgage Professionals Canada report that found Canadians would own between 4.5 to 5.5 homes in their lifetime – which translates to moving roughly every seven years for someone who bought their first property at 25 and stopped buying at 65. But the 2015 report turned out to be a red herring: It contained no such stat. When contacted by The Globe, report author and housing analyst Will Dunning speculated that any mention of the numbers 4.5 to 5.5 could have been erroneously pulled from an unrelated footnote. Then a new clue emerged: In a 2012 article, Royal LePage president and chief executive officer Phil Soper said, based on his own calculations, Canadians moved house roughly every five to seven years. He told The Globe that the company last surveyed Canadians directly on how often they moved roughly a decade ago, which is how it arrived at that range. Mr. Soper said Royal LePage periodically tests that assumption against data from the United States Census, which estimates Americans’ lifetime moves, and surveys from the National Association of Realtors in the U.S., which he said does more research than its Canadian counterpart. Royal LePage also looks at data from other moving and real estate associations, the Canadian Employment Relocation Council and Canada Post change of address data. Mr. Soper acknowledged affordability challenges could be limiting homeowners’ mobility, but said five to seven years continues to be a “reasonable planning assumption.” In an e-mail to The Globe, Statistics Canada communications officer Melissa Gammage said the agency doesn’t track lifetime moves. But Statscan data from last March found that in the two years leading up to 2021, 870,000 homeowner households moved, out of 15 million total households. With Canadian homeownership rates at 66.5 per cent, there are just shy of 10 million homeowner households – translating to only 4.3 per cent of homeowners who moved per year in that two-year period. Using those numbers, The Globe’s back-of-the-envelope math produced an average time between moves of roughly 23 years. “That’s too long,” Mr. Dunning said, given plenty of variability between homeowners – from Canadians who bought their home decades ago and never left, to those who buy a starter home and use it as a foothold to move quickly into another place. “It probably really is something in the area of seven to 10 years.” Aled ab Iorwerth, deputy chief economist at the Canada Mortgage and Housing Corp., said he doesn’t consider a potential average of 23 years between moves to be surprising, adding that it makes sense in a life-cycle context. “People start by renting and as they grow richer they move into homeownership. Once they get into homeownership they probably don’t move that often,” he said. A recent survey by Mortgage Professionals Canada had a similar finding. The survey, of just over 2,000 Canadian renters and owners, found that 43 per cent said they moved primary residences less than every 10 years, and 15 per cent said every six to 10 years. Fewer than 20 per cent of respondents combined moved more frequently than that. “My guess is that the rate of mobility is trending down,” Mr. ab Iorwerth said, though the CMHC hasn’t studied it. One of the main drivers of mobility is getting a new or better job, which is why the CMHC is particularly concerned about housing affordability in Vancouver, Toronto and Montreal. Those cities have started to see slower population growth, and Mr. ab Iorwerth said the CMHC believes home prices are the reason: “It’s deterring people from moving to cities” for work. He also pointed to CMHC’s January, 2023, report that found the rental turnover rate – the percentage of renters who vacate their unit per year – was at 13.5 per cent in 2021, down from 15.5 per cent in 2020, which he attributed to ultra-low vacancy rates in multiple markets. “People are finding it harder and harder to find a place to move into. That’s within the rental system, but also with higher mortgage rates they’re less likely to move into homeownership as well.” Long-term, Mr. Soper said he expects affordability issues to not be just a constraint on mobility but a driver of it, with Canadians migrating to less expensive regions to buy. It’s a trend he said seems to already be underway, with Alberta and the Atlantic provinces seeing the highest rates of interprovincial migration this year, according to Statcan. It’s a “seismic shift in migration patterns,” he said, given that British Columbia and Ontario used to be the top destinations for interprovincial migration. And with the country’s aging population, Mr. Dunning said he expects moving trends to slow, as people tend to move more when they’re young. He also expects home buying and selling to be impacted by the downstream impacts of the Bank of Canada’s interest rate hikes – even beyond the current market slump. “We’re still seeing a lot of construction going on, but those are houses that were sold when interest rates were at 2 per cent, not at 5 or 6 per cent,” he said. “We’re going to see housing starts fall a lot.”

Read MoreThe State of Commercial Real Estate in Canada

From a transactional standpoint, particularly for investments, it was one of the slowest years we’ve had in a long time. Inflation and subsequent interest rate increases prompted a sense of uncertainty across global real estate markets. Canadians spent most of the year asking whether interest rates would keep rising, and wondering what the effects of these elevated rates would be. The past 18 months have witnessed the impact of these rises, sending ripples through the commercial real estate (CRE) cap rate landscape—intricately influencing property valuation processes, dampening transactional activities, and curbing landowners’ enthusiasm for acquiring new properties or initiating fresh developments. As real estate inherently operates in cycles, we find ourselves navigating a transitional period, adapting to the enduring presence of elevated interest rates as we turn the page to 2024. A recession’s impact on the national market Statistics Canada reported that the national economy shrank in the third quarter by 0.3 per cent. The data agency’s preceding report showed a slight retraction in the previous quarter too, but those figures have since been updated to show 0.3 per cent growth last spring. Whether we’re on the verge of a recession or in the thick of it, there are some things to consider. In times like these, occupiers usually pull back on expansion plans, which will continue to drive up vacancies. We’ve been seeing this trend already, particularly in the technology sector. A recession may also start to shift the balance of power back towards employers as workers face more competition in a labour market that’s shedding jobs. Research has shown that managers are more interested in increasing in-office occupancy than their workers, so with more decision-making confidence, we could see higher office use, which could counteract the effects of some companies wishing to reduce their footprints. The biggest potential impact of a recession would be a reduction in interest rates. Economists from Benjamin Tal to David Rosenberg have predicted a significant reduction in rates over the next two years. Lower rates would reactivate the investment and lending markets, helping offset some of the expected increases in cap rates. When, and how fast that happens is up for debate. Managing distress Higher debt loads, interest rates and a lack of liquidity mean Canada will experience distress. While some companies will be challenged, deals will accelerate as organizations rebalance their portfolios and find strategic ways to weather the storm. We’ll witness companies fade, startups emerge and consolidation occur in both the private and public real estate markets. Promisingly, innovation and movement are a byproduct of hard times and a healthy and essential step in restarting the next cycle. Reconfiguring the office market By the final quarter of 2023, national office vacancy, including downtown and suburban markets, had flattened to 14.1%, according to Colliers’ National Market Snapshot Q4. Office vacancy has been climbing over the last three years and will likely continue to rise at a decelerated rate in the short term. Hybrid work has taken hold in Canada, but hybrid working does not mean 100% remote. Companies are clarifying their in-office work policies and we’ve learned that a combination of mandated in-office days, availability of diverse workspaces, and strategies that help to reduce commute times and costs all help contribute to more in-office time. Daily occupancy is still below 2019 levels, but signs are pointing to a gradual increase over time. The shifting office conditions also provide rare opportunities for tenants. Prior to the pandemic, the low vacancy levels shut many companies out of the market for prime downtown offices, restricting them to lower-quality buildings. Now, companies have the ability to relocate, expand or establish a presence in downtown office space at more competitive lease rates or with favourable incentives. We are seeing a flight to quality and a push towards bolstering amenities within buildings and the surrounding ecosystems. “Earning the commute” is increasingly important in traffic-heavy cities like Toronto, and creating a bustling downtown ecosystem is a key tool to create incentives to come to the office. For example, in Vancouver, downtown office vacancy reduced slightly to 11.8% at the end of 2023 with most absorption taking place towards the end of the year. Generating confidence In times of uncertainty, clients turn to their real estate service providers as advocates to help guide them with routes to recovery. At Colliers, we like to say that “experts choose experts.” Through various business streams including design, development advisory, placemaking, property and project management, appraisal, capital markets and leasing, we believe in being enterprising to help our clients both remain nimble and achieve long-term success. Macaulay Nicolls Maitland (now Colliers) office at the corner of Hastings and Howe in Vancouver, BC in 1929. Colliers, which has its origins in Vancouver, just marked its 125th anniversary. Over the decades, we’ve faced many challenges including both World Wars, pandemics, the Depression and recessions — and we’ve supported clients through the low points while generating value, sometimes in unexpected ways and places. Improving diversity It’s essential for the CRE industry to accelerate the pace of diversifying its workforce. We’ve improved this more in the last 15 years than in the previous 40 years, but more work must be done to evolve our talent rosters to welcome more talent from marginalized communities. Canada is a country built on diversity, and accessing all the talent, perspectives and experiences will strengthen our business and better enable us to help clients. The first step to progress on this front is measuring demographics as an organization because if you can’t identify your shortcomings, you can’t enable change. This must be followed up with a commitment to focus less on hiring, and more on recruiting. Our industry must broaden our recruiting base into different schools, communities, organizations, cultures and industries. Deepening and diversifying our talent pool will be crucial to meet the challenges of what lies ahead. Keeping things in perspective As we exit a year underscored by uncertainty and prepare to face the challenges of a probable recession, distress and a shifting office market, it’s important to recognize this as part of a familiar cycle. There is plenty of work to do, but Canadian commercial real estate continues to have a strong, long-term outlook supported by positive macro trends, like large immigration targets, a consistent labour market, a stable government and a track record of GDP growth.

Read More2023 marked slowest year in Canadian home sales in 15 years, but ended with December “bounce”

Canadian existing home sales reached their lowest level in 15 years in 2023, although the year did end on a high note with a “bounce” in activity in December. Total existing home sales for the year were down 11.1% compared to 2022, while listings were down 7.7% and average prices were 3.6% lower, according to data from the Canadian Real Estate Association (CREA). However, activity trended upward in December, with sales up 8.7% compared to November and the average non-seasonally adjusted selling price up 5.1% year-over-year to $657,145. “Was the December bounce in home sales the start of the expected recovery in Canadian housing markets?” wrote CREA’s senior economist Shaun Cathcart. “Probably not just yet.” “It was more likely just some of the sellers and buyers that were holding onto unrealistic pricing expectations last fall finally coming together to get deals done before the end of the year,” he added. “We’re still forecasting a recovery in housing demand in 2024, but we’ll have to wait a few more months to get a sense of what that ultimately looks like.” Regionally, 2023 sales fell the sharpest in the Atlantic region, specifically Nova Scotia (-17.2%), Newfoundland and Labrador (-15.2%) and New Brunswick (-13.5%). Sales in Prince Edward Island, however, were down just 5% year-over-year. Ontario saw a 12.3% decline in sales, and Alberta, which had outperformed most of the country throughout much of the year, saw a 9% decrease in sales. “Still, the national market ended the year in balanced territory,” noted Farah Omran of Scotiabank Economics. In terms of prices, the MLS Home Price Index (HPI), which adjusts for seasonality, ended the year 7% lower compared to 2022. However, that was still 6.5% above 2021 prices, which were 22.5% above 2020 levels, Omran added. New listings continued to drop in December, falling another 5.1% following previous consecutive monthly declines. That contributed to the sales-to-new listings ratio rising to 57.8%, though it remains well below its 10-year average of 61%. Months of inventory also tightened to 3.8 months in December, down from 4.2 months in November. CREA notes that the long-term average for this measure is five months. Cautious outlook Despite the uptick in activity in December, economists—and CREA itself—remain cautious that an upward trend in home sales is imminent just yet. “It’s notable that even CREA seemed a bit cautious on the outlook, even with this weather-aided rebound in December sales,” wrote BMO chief economist Douglas Porter. “One big plus for the market is the recent plunge in bond yields, which has carved the all-important five-year GoC by more than 110 basis points from the peak just three short months ago,” he added. “This rapid descent has translated into falling long-term mortgage rates, no doubt reviving sentiment. In addition, fiery population growth, still-decent employment gains, and rapidly rising rents are keeping important support squarely under demand.” Similarly, RBC Economics economists Robert Hogue and Rachel Battaglia expect softness in the real estate market to continue through at least the first half of 2024. “Our view is the Bank of Canada will pivot around mid-year and slash its policy rate by 100 basis points over the second half of this year, followed by further 100 basis points in 2025,” they wrote. “We see [home] prices firming up after activity has turned and demand-supply conditions have tightened sufficiently—possibly sometime in the third quarter.”

Read MorePosthaste: Why Canada's housing market could rebound sooner than many expect

Canada’s housing market is nearing a “tipping point” and its recovery will start sooner than many expect, says a new report by one of Canada’s leading real estate companies. “I believe the narrative suggesting that the housing market will rebound only when the Bank of Canada lowers rates misses the mark,” said Phil Soper, chief executive of Royal LePage said in the report released today. “The recovery will begin when consumers have confidence the home they buy today will not be worth less tomorrow. We see that tipping point occurring in the first quarter, before the highly anticipated easing of the Bank of Canada’s key lending rate.” National home prices slipped 1.7 per cent lower in the fourth quarter of 2023, showing that higher borrowing costs were still weighing on the market, said the report. Since the market’s peak in the first quarter of 2022, home prices have fallen 7.9 per cent. However, they still remain well above their pre-pandemic levels. In the fourth quarter, prices were 18.7 per cent higher than in the same period in 2020 and 22 per cent higher than in 2019. Overall economic conditions are good, said the report. Unemployment among the working-age population is low, savings levels are higher than normal and mortgage delinquency is at historic lows. “We believe many who need housing have the capacity to enter the market, they simply lack the confidence to transact,” Soper said. Inventories have increased as sales dropped this past year, but remain below historic norms, the report said. In the fourth quarter there were four months’ of inventory available in Canada, more than the two months during the housing boom, but less than between five and six months available in 2018 and the first half of 2019. “The fundamental shortage of housing supply in this country will inevitably put upward pressure on home prices when temporarily sidelined buyers return to the market in the months ahead,” said Soper. The Bank of Canada is widely believed to have completed this interest-rate hiking cycle and rate cuts are expected later this year. Some financial institutions have already begun to offer discounts on fixed-rate mortgages as bond yields decline. Over the next two years, 45 per cent of outstanding mortgages will be up for renewal, according to data from the Canada Mortgage and Housing Corporation. “That’s about 2.2 million households that will be renewing their mortgages, most at a much higher rate,” said the report. Among regional markets, Calgary bucked the national trend. This western city was the only market to post a quarterly home price gain at the end of 2023. Prices were up 10.7 per cent from a year ago to $663,500, the highest yearly appreciation in the country. October home sales in the city were the best on record for that month, said Corinne Lyall, owner of Royal LePage Benchmark. “The city continues to experience a wave of interprovincial migration as Canadians seek out more affordable living options, which is driving further demand for housing here.” In Toronto, the country’s biggest market, home prices fell 2.1 per cent in the fourth quarter from the quarter before to $1,123,300. They were up 5.1 per cent from the year before. Dropping sales have increased inventory in this city, but Karen Yolevski, chief operating officer of Royal LePage Real Estate Services Ltd., said housing stock in the Greater Toronto Area remains out of step with demand. “With new household formation from young Canadians, older generations wanting to age in place and a record number of newcomers entering the country, new construction cannot keep pace with the rate of demand,” said Yolevski. Royal LePage predicts that home prices nationally will rise 5.5 per cent in 2024. Both Calgary and Toronto are expected to beat that, with increases of 8 per cent and 6 per cent respectively.

Read MoreNational home sales in 2023 lowest since 2008 despite December 'bounce,' CREA says

Canada's housing market is seeing some of the lowest annual sales volumes in more than a decade, according to the latest statistics from the Canadian Real Estate Association, even though December saw a jump in sales compared to the month before. In a statement, CREA noted that the annual home sales total of 443,511 units in 2023 was a decline of more than 11 per cent compared to 2022, and "technically the lowest annual level for national sales activity since 2008." Pricing-wise, the national average sale price was 5.1 per cent higher in December 2023 compared to December 2022. But by some of the real estate board's calculations, prices dropped at the end of 2023 compared to November. However, when compared to November 2023, national home sales were up by 8.7 per cent in December. CREA is cautioning this may not be the start of a trend. "Was the December bounce in home sales the start of the expected recovery in Canadian housing markets? Probably not just yet," said Shaun Cathcart, senior economist for CREA, in a press release. TD Bank economist Rishi Sondhi agrees, writing last week that Canadians should be "cautious in drawing too many conclusions from December data," as it's usually a month with lower sales that could have been boosted by warmer-than-usual weather at the tail end of 2023. Some GTA markets in winter lull Robert Marsiglio, a real estate agent in Whitby, Ont., points out potential buyers and sellers "kind of pack it in" during the winter months, making real estate markets slower, but it hadn't been as busy as he'd expect from previous years. He told CBC News that the conversation with buyers has changed, too. In 2021 and early 2022, clients typically said "let's go to the top of our budget," while today's buyer is asking him, "How little can I get this house for?" "What a buyer is willing to offer on a property and what a seller is expecting, there's a gap that needs to be bridged somehow," said Marsiglio. "The only way you make that up is these buyers start earning more money overnight, rates come down magically or home prices correct to levels where things are relatively affordable again." While Marsiglio was speaking in early January, before statistics were released, his impressions have been borne out by the CREA data. The number of newly listed properties across Canada in December 2023 was more than five per cent lower than in November. Calgary: cold weather, hot real estate market Some real estate markets in Alberta are seeing a very different trend from the Greater Toronto Area when it comes to pricing. Calgary-based mortgage broker Max Singh said there's "a lot of demand" in his city, in particular when compared to the rest of the country. However, a common denominator is a lack of sellers listing their homes. "Rising values and limited supply are certainly a challenge for a majority of clients at this time," said Singh. "We're just getting used to the type of environment that existed in the Ontario and B.C. markets for years and years," he said, pointing out that multiple bids on homes in Calgary are common these days. Singh also noted that many buyers who are keeping those Alberta markets red hot are not from the province. "We've seen a lot of deep-pocket, out-of-province investors who can easily snap up properties and sweep some of those local folks off their feet with ... large, incredibly strong offers," he said.

Read MoreCanada real estate: Home prices up 4.3% in Q4, with higher prices expected in 2024

A new Royal LePage survey says national aggregate home prices in Canada increased 4.3 per cent in the fourth quarter of 2023, and that prices are expected to continue to rise in 2024. According to the Royal LePage House Price survey released on Monday, the aggregative price of a home in Canada increased 4.3 per cent year over year to $789,500. Royal LePage calculates aggregate prices using a weighted average of the median value of all housing types. On a quarterly basis, prices dropped 1.7 per cent, as higher interest rates continue to dampen demand in the housing market. The increase is below what Royal LePage had predicted earlier this year. It revised its fourth-quarter guidance in October in the wake of softer activity in the market, predicting that the aggregate price of a home would rise 7 per cent in the fourth quarter. Prices have not fully recovered from the post-pandemic correction, now 7.9 per cent below the peak reached in the first quarter of 2022. However, home prices are well above pre-pandemic levels, up 18.7 per cent compared to the fourth quarter of 2020, and 22.2 per cent compared to 2019. Royal LePage chief executive Phil Soper said: "I think the general public would be surprised to see how well the housing market has stood up during a post-pandemic correction." "It's quite remarkable that we could have the volume of sales drop by some 20 per cent, and yet home prices have stayed essentially flat. Typically, when demand falls off like that, prices would soften considerably," Soper said in an interview with Yahoo Finance Canada. Royal LePage sees a further recovery on the horizon in 2024, with the Bank of Canada expected to start cutting its key interest rate this year. The central bank aggressively hiked rates in the wake of high inflation over the last two years, bringing its benchmark rate to 5 per cent, the level it has remained at for three consecutive decisions. Economists widely expect that the central bank will soon begin cutting rates as the economy continues to show signs of weakening. But Soper says the housing market recovery won't require a steep decline in interest rates in order to kick off, as buyers look for signs of stability in the market. He notes that a small uptick in prices or indication that the market has shifted direction could be enough to trigger a recovery. "We believe it will happen this spring, with the bottom happening towards the end of the first quarter as the spring market rolls into life, and then prices will start to edge up modestly through the second quarter," Soper said, adding that Royal LePage expects the Bank of Canada to start cutting rates mid-year. "When that happens, we believe there will be a sharper uptick in both volume and home prices, with prices finishing the year up 5.5 per cent over where they were at the end of 2023." Royal LePage expects the aggregate price of a home in Canada to be up 3.3 per cent annually in the first quarter, up 0.2 per cent annually in the second quarter, up 3.3 per cent annually in the third before climbing 5.5 per cent annually by the end of the year. That will essentially return prices back to their pandemic peak, Royal LePage says.

Read MoreCanada’s housing market hit an ‘unexpected surge’ heading in 2024. Will it last?

Canadian home sales saw an “unexpected surge” in December as sellers and buyers came together to get deals done before the new year, according to the national real estate body, but experts are divided on whether the uptick will last. The Canadian Real Estate Association (CREA) said Monday that December saw an 8.7 per cent jump from November in the number of homes sold. That put the final month of the year on par with some of the “relatively stronger” spring and summer months, CREA said. CREA senior economist Shaun Cathcart said in a statement that it’s unlikely the surprisingly strong December was a sign of a housing market rebound kicking off. “It was more likely just some of the sellers and buyers that were holding onto unrealistic pricing expectations last fall finally coming together to get deals done before the end of the year,” he said. “We’re still forecasting a recovery in housing demand in 2024, but we’ll have to wait a few more months to get a sense of what that ultimately looks like.” BMO chief economist Doug Porter pointed to unseasonably warm weather and a “sudden pullback” in long-term borrowing costs as likely factors behind the December bump. Declining bond yields, tied to expectations for rate cuts from the Bank of Canada in 2024, have pushed down some fixed mortgage rates by more than a percentage point from recent peaks seen in late October. Some buyers may have been inclined to purchase a home as last year wrapped up in order to get ahead of the anticipated 2024 boom, said Cailey Heaps, president of the Heaps Estrin Real Estate Team in Toronto. Although borrowing costs are still high, with the central bank holding its key rate at five per cent, she said those looking to make a move now have the advantage of potentially finding good deals on the market due to lower demand and less competition. “The primary advantage is we will likely see upward pressure on pricing once the rates start to drop,” she said. “You’re locking into a higher rate, but … you just factor it into your purchasing price and your overall budget.” There were few people listing their homes in the traditionally slow December, CREA said, pushing the sales-to-new listings ratio back up to 57.8 per cent from just over 50 per cent in November. This key metric helps to gauge whether markets favour buyers or sellers, with CREA putting the long-term average of around 55 per cent. The volume of home sales were up 3.7 per cent year-over-year in December. Looking back at the whole year, CREA said there was a total of 443,511 home sales in 2023, down 11.1 per cent from the year earlier when the Bank of Canada’s interest rate tightening cycle — and by extension, the housing correction — began. CREA said 2023 was the lowest annual level for national sales since 2008. Last year was nearly on par with the five years following the financial crisis of that year, and the first year of the mortgage stress test in Canada in 2018. On a non-seasonally adjusted basis, the national average home price hit $657,145 to close the year, up 5.1 per cent from December 2022. CREA noted that ongoing price declines are mainly concentrated in Ontario’s Greater Golden Horseshoe region as well as some markets in British Columbia. Elsewhere, prices are holding firm or climbing in some provinces including Alberta, New Brunswick and Newfoundland and Labrador. What does 2024 hold for real estate? CREA also updated its 2024 housing forecast on Monday. The association said it expects 489,661 residential properties to be sold this year — a 10.4 per cent increase from 2023 — and the national average home price to climb 2.3 per cent on an annual basis to $694,173. Noting that Canadian housing markets have remained quiet since the Bank of Canada’s interest rate hikes last summer, the association said there’s reason to be optimistic in the new year with expectations for the timing of the first 2024 rate cut pulled forward. “The real test of the markets’ resilience will be in the spring,” said CREA chair Larry Cerqua in a press release. National Bank economist Daren King said data trends from Canada’s largest housing markets — Toronto, Vancouver, Montreal and Calgary — suggest November was likely the trough for home sales, but he agreed the strong figures last month were not necessarily “a sign that the real estate market is now on the rise for good.” “We’re seeing economic growth decelerating, the job market also is not as good it used to be, we’re seeing the unemployment rate increasing, so of course, we’ll have some headwinds ahead,” King said in an interview with the Canadian Press. “When we will have more confidence that the Bank of Canada will start decreasing their interest rate — we’re expecting it to decrease in April, probably — at that point, we can expect the real rebound then.” Others feel the recovery might come earlier than that. A separate report released Monday by Royal LePage suggested the Canadian market is showing signs of home price stability, with the aggregate price of a home increasing 4.3 per cent annually to $789,500 in the fourth quarter of 2023. Buyer sentiment can have an equal effect on market trends as inventory or interest rates, according to Phil Soper, president and CEO of Royal LePage. “I believe the narrative suggesting that the housing market will rebound only when the Bank of Canada lowers rates misses the mark,” he said. “The recovery will begin when consumers have confidence the home they buy today will not be worth less tomorrow. We see that tipping point occurring in the first quarter, before the highly anticipated easing of the Bank of Canada’s key lending rate.” Heaps said the market is anticipating an increase in inventory this year, which adds another layer to the dilemma some buyers face before the cycle of rate cuts gets underway. “Do you buy something now because you feel you’re going to get ahead of the market pricing, knowing that there might be more options in the spring? Or do you wait for more options?” she said. “That’s a very subjective decision that people will make.”

Read More'Cash for keys' offers on the rise in Toronto, real estate professionals say

Instances of landlords offering cash for tenants to vacate a unit have risen in Toronto, according to real estate professionals in the city. Real estate experts say the practice is still relatively uncommon, but they have been seeing it more frequently in Canada’s biggest city as landlords face financial pressures such as higher interest rates. Natalie Costello, founder of Natalie Costello Real Estate, told BNN Bloomberg that the practice of cash offerings for apartment keys has been on the rise. Last year, she started personally helping three clients through the process. “Unfortunately (it’s) not an urban legend, this is a very real thing that we are seeing more predominantly over the last little while,” Costello said. “I’ve spent over a decade in this industry and we heard whispers of it before, now it has become more prevalent.” WHAT ARE 'CASH FOR KEYS' OFFERS? Bob Aaron, a Toronto real estate lawyer, told BNNBloomberg.ca that as Ontario has been under rent control regulations for decades, sometimes a landlords want to sell a unit or raise rent beyond what the current tenant pays. Landlords have three options in that case, Aaron explained: they can legitimately move into the unit themselves, do an extensive renovation or buy a tenant out. “Colloquially that’s known as cash for keys,” he said. “It becomes something of a dance. A tenant will ask for a very high amount, the landlord will offer a very low amount and then they have to come to some conclusion or the tenant just remains there.” WHERE DO THEY HAPPEN? While there is not a “dramatic amount of these cases,” Daniel Vyner, principal broker at DV Capital, said cash for keys offers appear to be increasing, mostly from real estate investors looking to sell their properties. “The analogy ‘cash for keys,’ I've heard about that for many years, but it was really 2023 where I started firsthand hearing and seeing these situations,” Vyner told BNNBloomberg.ca in an interview. The Toronto broker said cash-for-keys offers happen most often in rent-controlled condos due to cash-flow issues when tenants’ monthly rent payments “are insufficient” to cover the cash-flow expectations of a real estate investor, he said. Those scenarios have become more frequent over the past year, Vyner said, as investors have had their finances squeezed by higher interest rates. Delays at the tribunal that handles landlord-tenant disputes in Ontario may also be contributing. Aaron noted that if a landlord wants to move into a unit, tenants are entitled to ask for hearing at the Landlord and Tenant Board – but it can take between six months to a year for a case to be heard, depending on what jurisdiction the property is in, he said. RANGE OF PAYMENT AMOUNTS Costello said she has seen a broad range of “cash for keys” offers. “I’ve seen and heard anywhere from $10,000 to $30,000, so (it) just depends on the situation and it also seems to depend on the amount of rent that they’re paying,” she said. Vyner said the most common payment amount he has heard of totals about six months of the tenant's rent, but he has heard of offers amounting to a year's worth of rent. “It depends on the severity of the situation (and) the vulnerability of the owner,” he said. Aaron said he has seen low monetary offers, around $2,000, and instances where a tenant asks for as much as $25,000. “When landlords ask me, ‘How much should I pay,’ I tell them to do a risk-benefit analysis,” Aaron said. “What percentage of the sale price is the tenant asking for? Is it one per cent, two per cent, 10 per cent? And what is the landlord's downside risk if the tenant stays there?” HOW COMMON ARE OFFERS? Aaron said that he has seen three instances of cash for key offers over the “last couple of years.” However, he noted that some cases “may never get to a lawyer,” as people may only seek legal advice if negotiations are ineffective. Vyner said he directly or indirectly heard about “cash for keys” offers about once a week throughout most of 2023. Offers of this type could become more common, he added, as mortgages are renewed at higher interest rates in the coming years, “which would further erode profitability if the current monthly lease isn’t increasing.” TENANT RIGHTS In cases like this, Aaron said Ontario law is clear that “the tenant is entitled to stay” in the unit paying the same rent, unless they are in default, come to an agreement with the landlord, or if the landlord moves in or does extensive renovations. “A tenant is entitled to stay forever. There's a 2.5 per cent annual increase, so they'll have to pay that,” he said. Aaron said that even if the tenant receives an offer, it may not offset a potential rent increase from moving. “I can understand that tenants don't want to move because no matter how much money they get from a landlord, whether it's $1,000 or $10,000 or more it's not a windfall. They're going to have to turn around and pay market rent on an equivalent unit,” he said.

Read MoreCanadian seniors are selling their homes later in life. What will this mean for the housing market?

A recent report has found Canadian seniors are choosing to age in their homes for longer, with many not selling their home until their 80s and 90s. The findings were revealed in the Housing Market Insight Report by the Canada Mortgage and Housing Corporation (CMHC), which explored some of the expected implications on housing supply in the coming years. According to the CMHC, more seniors are potentially staying homeowners well into their later years because many are simply living longer, healthier lives and can handle the maintenance of a home. The study, which focused on elderly Canadian households in the country’s six largest cities, also identified differences based on location. For example, households in Toronto and Vancouver are the most likely to transition to condominiums as they age, where in Montreal there’s a preference for moving to rental housing. “In Canada, the financial wealth of elderly households may also vary from one urban centre to another,” says the CMHC in its report. “Affluent households may therefore be able to remain homeowners and purchase a home that meets their needs, rather than rent one.” Canadian seniors are most likely to sell in their nineties Canadian household census data show an estimated exponential sell rate trend amongst seniors from 2016 to 2021. Following consecutive cohorts over time, the data show a higher prevalence of significantly older seniors selling or giving up their homes compared to younger seniors. CMHC defines the sell rate as the ratio of homeowners who sold their properties to the total number of homeowners for that particular demographic. For example, between 2016 and 2021, 100,500 homeowners aged 75 to 79 let go of their properties out of an initial total of 466,775 owner households, resulting in a sell rate of 21.5%. CMHC adds that the sell rate for households aged 75 and above has been trending downward since the early 1990s, falling on average six percentage points in that time. Based on these calculations, the data show most Canadians wait until they’re in their nineties to give up their home. Cohorts that are approaching or in their 90s are expected to sell their homes and potentially open up additional housing supply to the market in the coming years. “They might, for example, decide to rent private housing or, for health reasons, move into public housing (such as a care centre for seniors),” the CMHC report says. “Deaths are another factor that brings properties onto the market.” What does this mean for Canadian housing availability? While CMHC says it will still take a few years to have older seniors list their homes on the market, the result has the potential to eventually increase housing supply and subsequently narrow the affordability gap in Canada. The result “seems to indicate that the number of units sold by elderly households might increase more rapidly once population aging in Canada is more advanced,” CMHC said. “In other words, when the number of households over age 85 grows larger.” According to projections from Statistics Canada, population growth in the 85-and-over age group will rise more rapidly from 2030 to around 2040 due to the first baby boomer cohorts reaching this age group. For now, it may be a waiting game to see if and when housing supply increases as expected. “The big question is whether, in the coming decades, elderly households will follow in the footsteps of previous generations or go their own way,” says CMHC. “For example, will aging in place become more popular with seniors? Will the recent rise in rental housing starts in various CMAs across the country encourage more senior households to opt for renting?” Until then, restoring housing affordability in Canada will largely depend on how senior household sales unfold in the near future.

Read MoreWeak demand casts chill over Canada’s recreational property market outlook