More Canadian Seniors Have Mortgages Than Young Adults

In a surprising shift, more Canadian seniors now have mortgages than young adults under 35. According to the Bank of Canada's 2024 mortgage data, nearly half (49%) of mortgage debt is held by those aged 45 to 64, while another 26% is owed by people between 35 and 44. Together, these two age groups

Read MoreHousing Trends: Affordability at the Forefront

In 2023, Toronto continued to lead the way in housing searches, with one-bedroom rents averaging $2,374 and home prices at $1,061,700. Vancouver followed closely behind, boasting the highest rents in Canada at $2,534 and even higher home prices, averaging $1,172,100. For those seeking more affordab

Read MoreToronto’s Luxury Home Sales See a 58% Surge

The luxury housing market in Toronto experienced a significant boost in the last quarter of 2024, with sales of homes priced over $3 million increasing by more than 40% compared to the same period in 2023. More than 360 freehold homes and condos were sold in Q4, a notable rise from 259 sales in the

Read More2024: A Strong Year for Calgary’s Housing Market

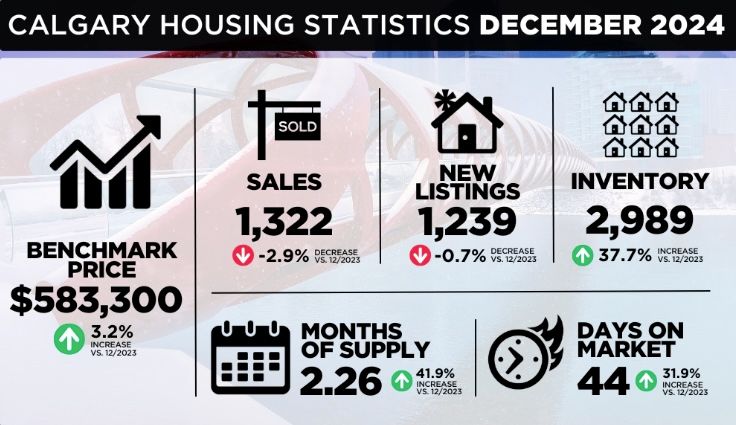

Calgary's real estate market closed 2024 with strong sales, totaling 1,322 in December—a slight dip of 3% from last year but nearly 20% above the long-term average. While overall sales were close to last year's levels, growth in higher-priced homes offset slower sales in lower price ranges due t

Read MoreThe Top Five Stories That Defined 2024 for Canadian Realtors

As 2024 comes to a close, the Canadian real estate industry has seen notable changes. Here’s a quick look at the top five stories that have had the most impact this year, setting the stage for 2025 and beyond. Competition Bureau Investigates CREA The Canadian Competition Bureau is investigati

Read MoreB.C. man fined $2M for tax evasion after flipping 14 homes in four years

A British Columbia man who flipped 14 properties in just four years has been hit with a $2 million fine for tax evasion. Balkar Bhullar, a Richmond resident, was convicted of failing to report nearly $7.5 million in income from 2011 to 2014. The Canada Revenue Agency (CRA) announced that Bhullar w

Read MoreCanada's Housing Market Shows Strong Momentum Heading into 2025

This fall has been an unusually busy time for much of Canada’s housing market, with some areas continuing to see strong activity into December, fueling optimism for 2025. The positive outlook is largely driven by recent federal policy changes, including continued interest rate cuts by the Bank o

Read MoreThe Path to Recovery for Canadian Real Estate

Canadian real estate seems to be on the path to recovery, with interest rates falling, house prices down from their peaks, and affordability slowly returning. The government is actively addressing housing issues, but the big question is: when will the market truly recover? It’s felt more like a

Read MoreCanadian Home Sales Keep Rising in November

Canadian Home Sales Keep Rising in November Home sales in Canada continued to rise in November, up 2.8% from October and 18.4% higher than in May, before the first interest rate cut. The boost was driven by gains in Greater Vancouver, Calgary, Greater Toronto, Montreal, and some smaller cities i

Read More-

Home sales in Vancouver saw a nice boost in November, thanks to a jump in new listings that helped keep prices steady, according to the local real estate board. The composite benchmark price for November was $1,172,100, which is slightly down by 0.9% compared to last year and basically the same

Read More Canadian Housing Market Set for Stability, with Prices Projected to Increase by 6% in 2025

The Canadian housing market is set to find its footing in 2025, as lower interest rates and new lending rules are expected to attract more buyers. The real estate company predicts that the average home price in Canada will rise by 6% year-over-year, reaching $856,692 by the fourth quarter of 2025,

Read MoreSupply is increasing, but not evenly across all price segments.

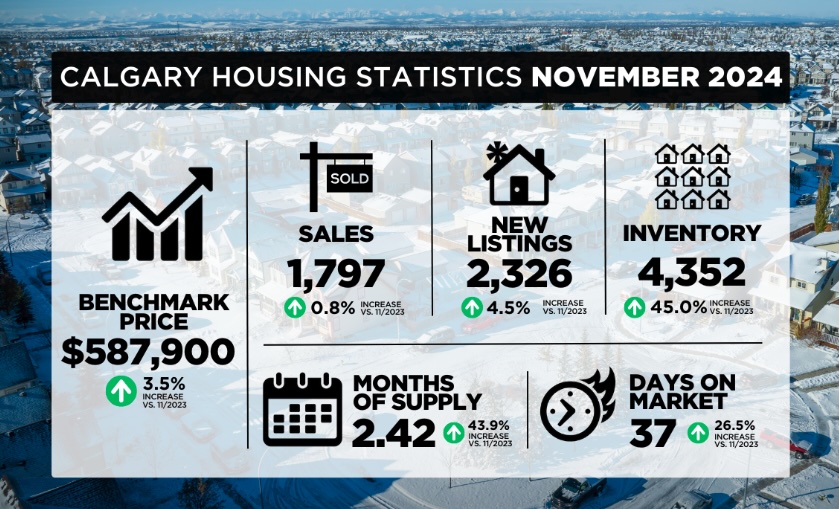

As we head into winter, Calgary’s housing market is following typical seasonal trends, with slower activity compared to the fall, but year-over-year demand remains strong. November saw a mix of increased sales in detached, semi-detached, and row homes, though apartment condo sales slowed. Overal

Read More-

Re/Max Canada’s 2025 Housing Market Outlook Report predicts that interest rate cuts and growing consumer confidence will likely spur more activity in the market. However, with demand outpacing supply, the national average residential sale price is expected to rise by about 5%. The report surveyed 3

Read More Minimum Qualifying Rate for Uninsured Mortgages: Why It Matters

The Minimum Qualifying Rate (MQR) for uninsured mortgages is a stress test that helps lenders ensure borrowers can still afford their mortgage payments, even if their financial situation changes (like a job loss, higher living costs, or rising interest rates). This requirement, set by OSFI, helps

Read MoreFour out of Five Canadians Report that the Housing Crisis is Influencing their Life Choices

Homeownership is feeling increasingly out of reach for many Canadians, according to a recent survey from Habitat for Humanity Canada. A significant 80% of Canadians now view buying a home as a luxury, and 88% of renters feel that the dream of owning a home has turned into a distant goal. This su

Read MoreImproved Supply for Higher-Priced Homes Brings Balance to the Market

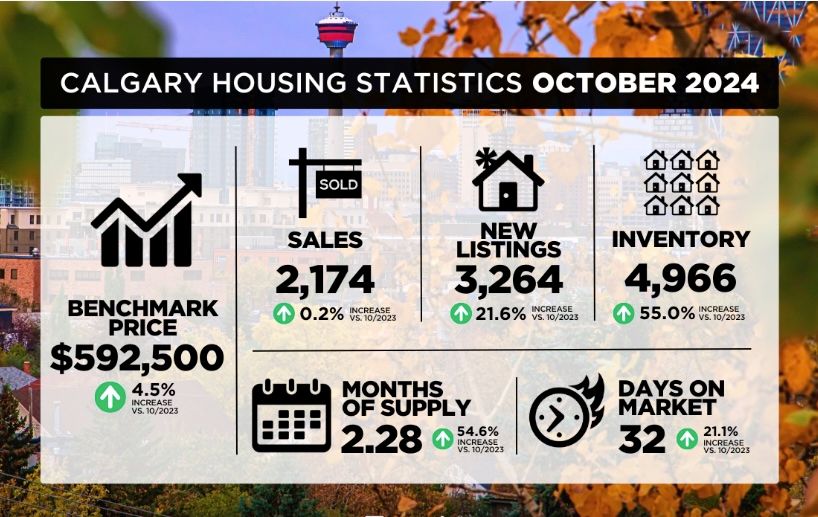

The housing market saw a bit of a shift in October, with sales of higher-priced homes (those over $600,000) helping to balance out slower sales at the lower end. Overall, 2,174 homes were sold in October, a nice bump from September, and 24% higher than the usual trend for the month. “Housing

Read MoreLuxury Homebuyers Set for "Best Conditions in Years"

If you've been eyeing a luxury home in Toronto or Vancouver, the latest market conditions are some of the most favorable since 2017, according to experts at Sotheby’s International Realty Canada. In their Fall 2024 State of Luxury Report, they highlight a shift in Canada's luxury real estate mar

Read More6 Things Parents Should Keep in Mind When Helping Their Child Buy a Home

If you're thinking about helping your child buy a home, it's important to approach it carefully to ensure everything goes smoothly for everyone involved. Here are six key things to consider: Communicate with the Whole Family Before you step in to help with a down payment, it’s important to talk

Read MoreCalgary Real Estate Market Overview – October 2024

Calgary Real Estate Market Overview – October 2024 Average Home Prices Calgary's home prices have been on the rise for the past four years and are now starting to stabilize, holding steady near their peak. In October 2024, the average home price in Calgary was $620,946, up 14% compared to October 2

Read MoreNew Home Sales in Toronto Stay Low in September, But There's Hope for Buyers!

New Home Sales in Toronto Stay Low in September, But There's Hope for Buyers! New home sales in the Greater Toronto Area saw a slowdown in September, but a recent report hint that now could be a great time for buyers! The Building Industry and Land Development Association (BILD) shared its latest

Read More

Categories

Recent Posts